U.S. TRAVELERS PUT HOTELS ON THE COMEBACK TRAIL:

A Light at the End of the Tunnel is Emerging for Weakened Hotel Valuations

January 2024

The U.S. hospitality sector has staged a well-earned occupancy and RevPAR performance turnaround since the pandemic era even in the face of economic headwinds, and market participants might owe a nod to the Taylor Swift economy. The stars began to align for hotels in 2023 thanks to a market trifecta comprising pent-up travel demand in a post-COVID world, resilient consumers, and a desire among employers to recapture a face-to-face culture, a recovery that’s expected to extend in the new year.

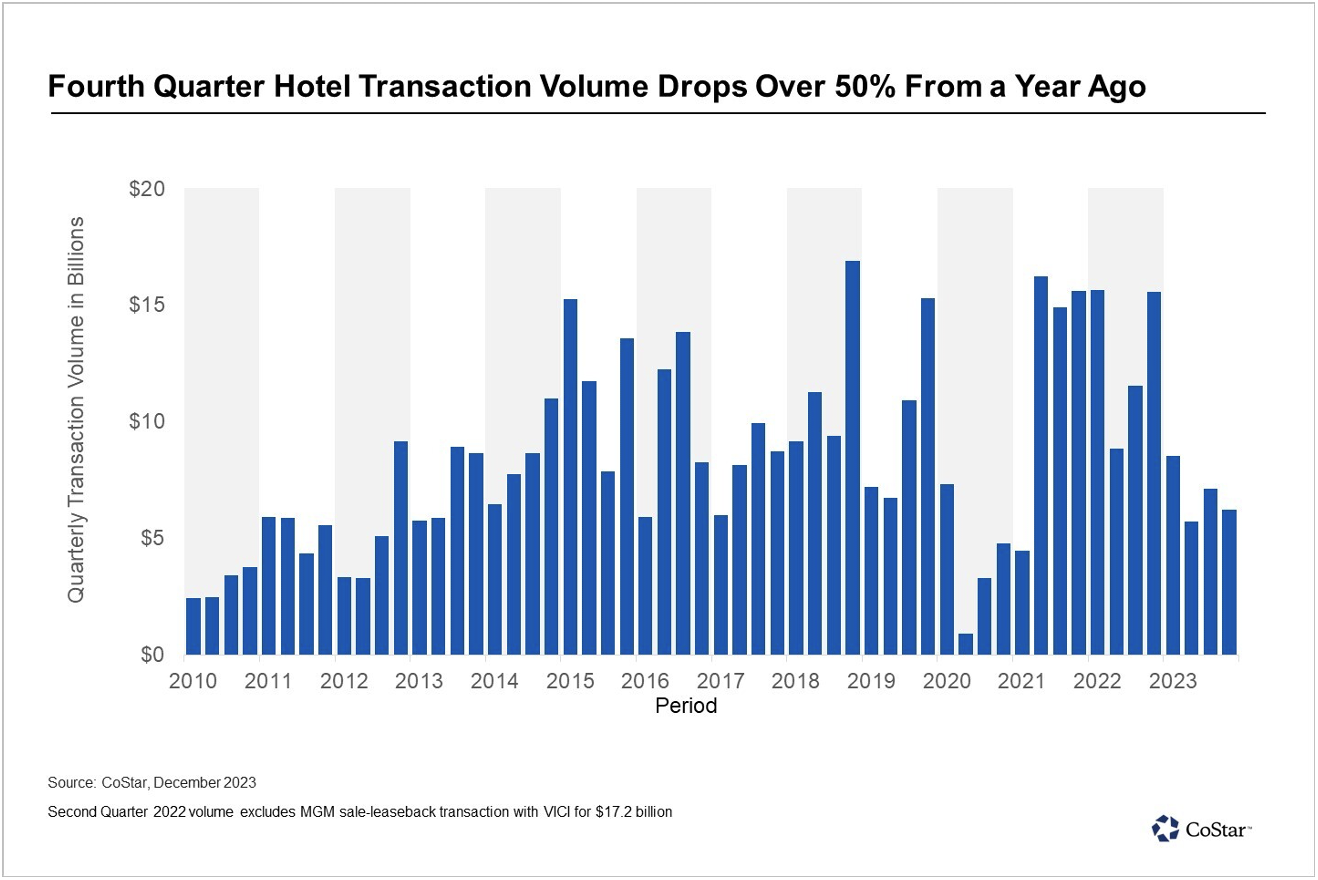

However, the full picture is a little more nuanced. Hotels that were stable or well-supported enough to battle through the pandemic have emerged into a challenging capital market environment that has weakened hotel valuations and hampered transaction volume throughout the sector. In many ways, it’s a tale of two markets, with diminished property values amid the high interest rate environment on the one hand and pent-up demand boosting revenue on the other.

(Click image to view larger)

A fuller market recovery is expected to unfold throughout 2024 and into 2025; in the meantime, owners and investors can expect to enjoy healthy revenue performance, which may help to offset recent or upcoming recapitalizations due to debt maturities.

MARKET PERFORMANCE

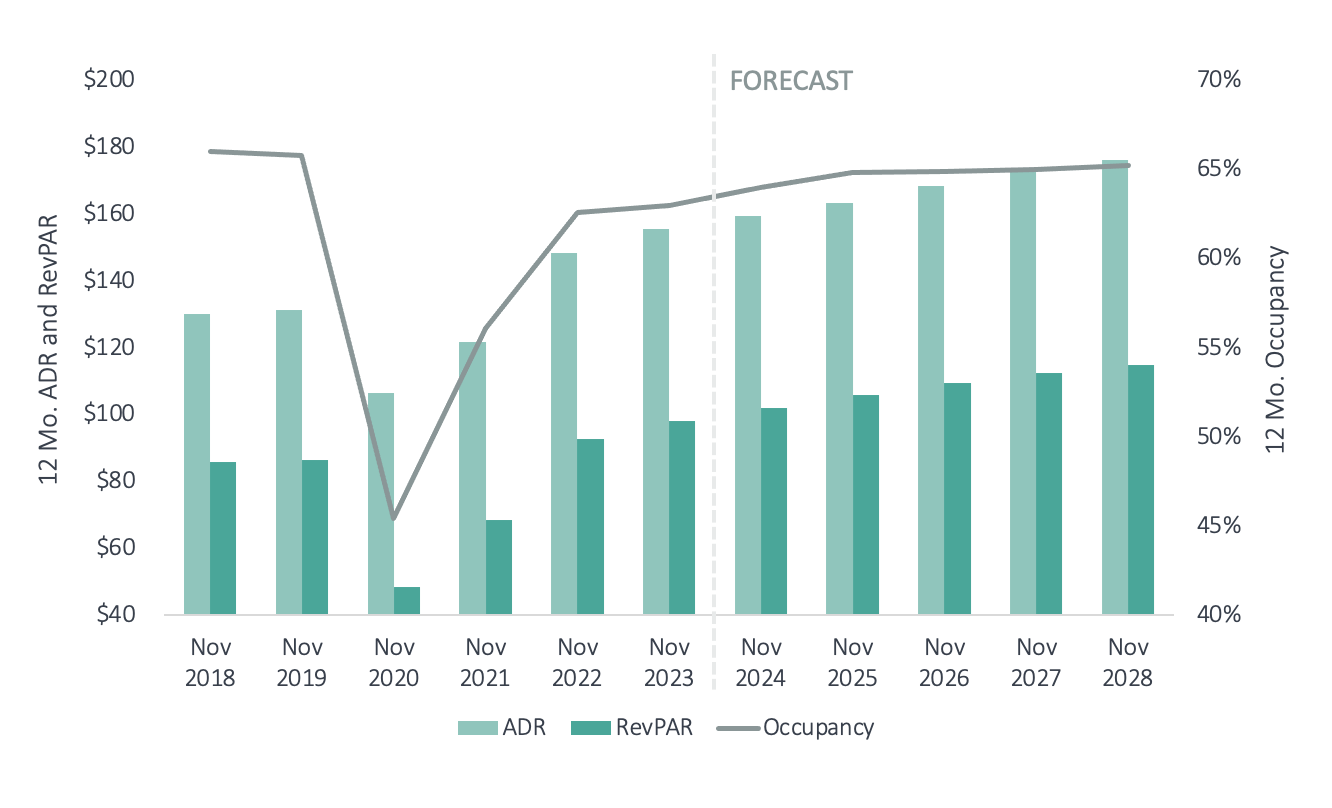

As of year-end 2023, U.S. hotel revenue per available room (RevPAR) was up over 5% compared with 2022 levels, outpacing an historical average of 2.7%, as per CoStar data. At roughly 64%, occupancy fell slightly short of a forecast average of nearly 65%.

Hotels in 2024 have momentum on their side, with RevPAR forecast to expand between 3% and 4% while occupancy should hold steady.

U.S. Hospitality Market Forecasts

(Click image to view larger)

Source: CoStar as of January 2024.

3 DEMAND DRIVERS

Hospitality demand drivers are three pronged, comprising business, leisure, and group travelers, each of which is charting its own course.

Group Travel: Group demand has been out front, owing to a couple of catalysts. Among them, employers are eager to reconvene staff in hopes of rebuilding a face-to-face company culture that was weakened as part of the fallout from a remote workforce.

Leisure Travel: Consumers have in many ways been the hero of this economy, including travel spending. According to Oxford Economics, consumers have been directing more of their discretionary income and surplus savings achieved during the pandemic toward leisure traveling, catapulting the “travel share of the wallet” back to pre-pandemic levels.

Corporate Travel: One area that has lagged in hospitality is transient business travel due to a slow return to offices in corporate America. As a result, the transient corporate category continues to hover below pre-pandemic levels, according to CoStar. However, Euromonitor predicts that spending on global “bleisure” travel, a blend of business and leisure agendas, will more than double by 2027.

HOTEL SUPPLY & MAINTENANCE

In a distinct initiative, numerous hotel franchisors are collaborating closely with their aging affiliated hotels; they are modifying property improvement requirements and timelines to safeguard and enhance cash flow.

Regarding new hotel supply, planned projects in the pipeline are on the rise, but not all of them are expected to break ground. In fact, the pace of development has stalled, with the number of hotel rooms under construction as of October 2023 flat with year-ago levels, as per CoStar data.

This bodes well for existing hotel capacity, particularly in markets with large populations that are also go-to destinations for business and leisure travelers, like Atlanta, Georgia, Miami, Florida, Chicago, Ill., or New York, giving investors reason to feel upbeat about the outlook.

HOSPITALITY MARKET HEADWINDS EASE

Valuations are a sticking point, with the Green Street Commercial Property Price Index falling 10% in 2023. However, according to Green Street’s Peter Rothemund, the worst of the correction in commercial real estate pricing “appears to have run its course.” For now, hotel bid and ask spreads continue to hover at opposite ends of the spectrum while the market awaits hopeful interest rate relief in the coming months as it targets a full recovery. According to analyst firm Jefferies, the improved interest rate outlook paves the way for higher hotel valuations.

Meanwhile, since the pandemic, a one-two punch of labor shortages in hospitality and supply chain issues in aviation, e.g. stalled aircraft deliveries, have constrained the industry, forcing market participants to navigate these choppy waters. An exodus of tourism talent in recent years caught the hotel industry unaware when demand suddenly rebounded after the pandemic. Fortunately, labor conditions are looking up in 2024, as a bounce in leisure and hospitality jobs fueled the addition of 164,000 private payrolls in December, as per ADP data.

THE TAKEAWAY

The hospitality sector has weathered market storms before and survived. Forecasts are calling for blue skies in 2024, especially in Q2 and Q3, as demand is poised to jump by a double-digit percentage year-over-year. With the Federal Reserve likely to play nice on interest rates this year, there may be a hotel industry recovery for the ages on the horizon.

The information contained herein is for informational and educational purposes only and is not an offer to sell or a solicitation of any offer to buy any securities. The information contained herein is not intended to and does not constitute investment, legal, or tax advice, or recommendation of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Any investment in securities involves a high degree of risk and may not be suitable for all investors and you should consult with an expert before making investment decisions. The views or opinions expressed herein represent those of Ignite Investments, LLC (“Ignite”) or its affiliated sponsors at the time of publication. No assurance can be provided that any of the future events referenced herein (including but not limited to projected or estimated returns or performance results) will occur on the terms contemplated herein or at all. While the data contained herein has been prepared from information that Ignite believes to be reliable, Ignite does not warrant the accuracy or completeness of such information. Please see Terms & Conditions for full disclosures.

The forward-looking information prepared by CoStar Realty Information, Inc. (Licensor) and presented herein is based on information from public and proprietary sources, as well as various assumptions concerning future events that are uncertain and subject to change without notice. Actual results and events may differ materially from those expressed or implied by the Licensor data presented. All Licensor data contained herein speaks only as of the date referenced, may have materially changed since such date, and is provided “as is” with no guarantee or warranty of any kind. Licensor has no obligation to update any of the Licensor data contained herein. None of the Licensor data contained herein should be construed as investment, tax, accounting or legal advice. The Licensor data contained herein speaks only as of the date referenced, may have materially changed since such date, and is provided “AS IS” with no guarantee or warranty of any kind, either express or implied. Licensor has no obligation to update any of the Licensor data contained herein. None of the Licensor data contained herein should be construed as investment, tax, accounting or legal advice.

© 2023 IGNITE INVESTMENTS, LLC