HOUSING MARKET PIVOTS AS RENTERS PLAY FOR KEEPS

Millennial Renters are Reshaping

the American Dream

February 2024

While homeownership helped to define the lives of Baby Boomers and Gen Xers, today’s challenging economy with lofty interest rates and high inflation has made the American dream increasingly difficult to attain for younger generations. As a result, rental demand has surged, buoyed of late by would-be homeowners who have scoffed at mortgage rates in favor of paying rent, some of whom have earned a reputation as “forever renters,” as coined by The Wall Street Journal. Renters have been drawn to the comfortable lifestyle that multifamily living has to offer, not least lower prices compared with mortgage payments in this economy.

As the biggest U.S. generation, Millennials play a pivotal role in shaping homeownership trends. It’s not that Millennials, who are between the ages of 27 and 42, are not interested in real estate. Rather, with mortgage rates once again pushing 7.0%, Millennials are pursuing homeownership at a slower pace than their older counterparts. Upon turning 34 years old, a mere 52.7% of Millennials became homeowners compared with 57% and 58.9% of Gen Xers and Baby Boomers, respectively, at the same age, according to a Zillow analysis.

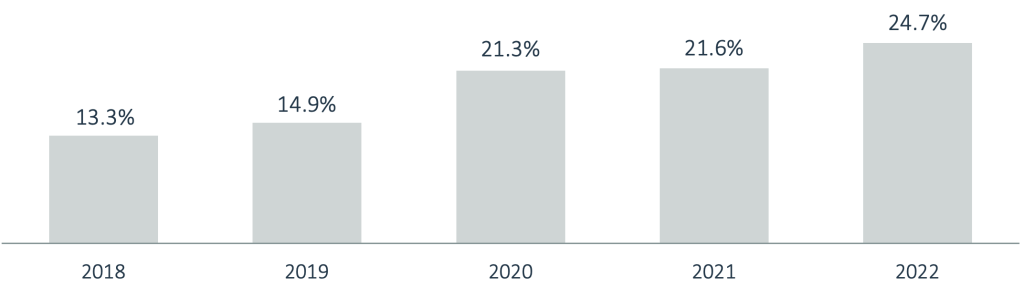

It is not too shocking considering many Millennials reached homeownership age in the middle of the Great Recession, only to be met with a one-two punch of the pandemic and high interest rates. In response, the share of this cohort willing to embrace renting indefinitely has been on the rise, increasing from 13.3% in 2018 to nearly 25% as of 2022, according to data from online rental marketplace Apartment List. And they are not alone in this trend.

Annual Share of Millennials Who Plan to Always Rent

(Click image to view larger)

Source: Apartment List Survey Data. Sample limited to Millennials who do not already own a home.

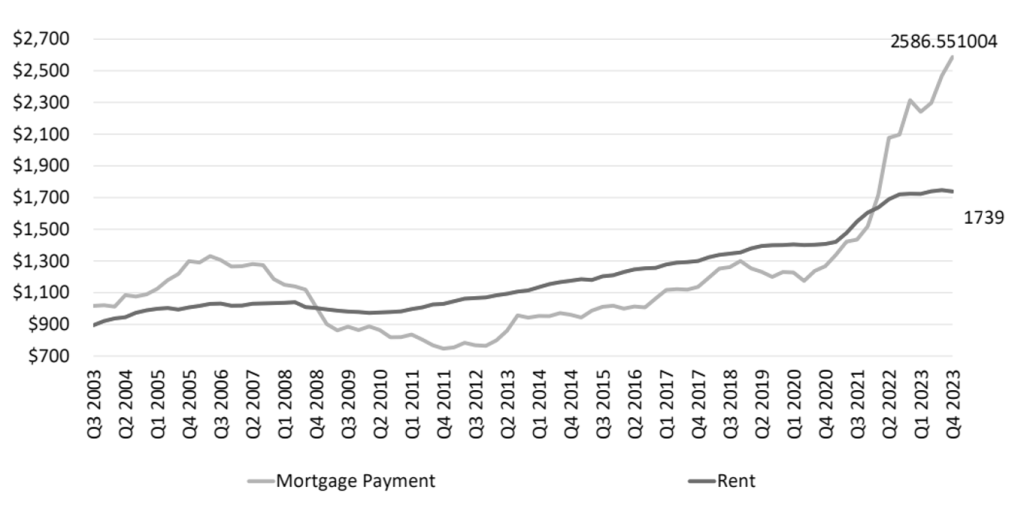

RENT PRICES VS. MORTGAGE PAYMENTS

One of the key drivers of rental demand has been affordable rental prices, especially when compared with mortgage rates. The U.S. Federal Reserve’s monetary policy through which it has raised rates 525 basis points since 2022 has sent mortgage rates soaring. In response, the 30-year fixed rate on conforming mortgages has once again risen above 7.0% as of mid-February. Unsurprisingly, home mortgage payments have exceeded typical rental prices, acting as a formidable obstacle for first-time homebuyers in today’s market. This disparity is deterring potential homeowners from entering the market in the near future. According to Yardi Matrix’s Multifamily National Report, the average home mortgage payment is inching closer to $2,600 while rents are hovering below $1,750. It’s a phenomenon that is not lost on renters, many of whom are settling in for good.

Home Mortgage Payments Well Above Rents

(Click image to view larger)

Source: Yardi Matrix

A CULTURAL SHIFT TO RENTING

The origins of the forever renter movement were revealed in corporate America during the pandemic, when remote and hybrid work models took off, resulting in a more flexible environment in which people could live and work from any city they chose. This shift in work culture significantly influenced market dynamics, drawing more people towards the rental lifestyle and to Class A developments that may feature swimming pools, dry cleaning, and concierge services. Consequently, last year witnessed the delivery of a historic number of multifamily units, which is now actively being absorbed by the market.

Meanwhile, renter demographics are changing, too.

- High-income renters, including those earning annual income above $100,000, are increasingly entering the fray, comprising more than 5% of renters in 2021 compared with a mere 2% in 2012, as per WSJ data.

- Renter households with income surpassing $1 million hit a fresh all-time high in 2022, increasing to over 4,450 compared with fewer than 1,000 households five years prior. Some long-term renters have no intention of ever becoming homeowners.

Millennials are passing the rental torch on to Gen Z, perpetuating the rental trend. With Millennials getting older in relation to the prime rental age group of 20-34 years old, all eyes are on Gen Z, the oldest of whom are in their mid-20s. According to a Harvard University study, “The number of renter households Gen Z adds in the next 15 years will be an important pillar of rental housing demand.”

HOOKED ON RENTING

Yardi Matrix forecasts that demand for multifamily housing will persist through 2024, owing to market conditions that favor renters. Even if the Fed decides to reverse course on interest rates, it will likely take a while for any relief to be felt in the housing market. While short-term conditions are not perfect, primarily due to headwinds such as oversupply, a high cost of capital and an uncertain economy, the growing demand for rentals suggest a robust market for multifamily properties over the long-term.

The information contained herein is for informational and educational purposes only and is not an offer to sell or a solicitation of any offer to buy any securities. The information contained herein is not intended to and does not constitute investment, legal, or tax advice, or recommendation of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Any investment in securities involves a high degree of risk and may not be suitable for all investors and you should consult with an expert before making investment decisions. The views or opinions expressed herein represent those of Ignite Investments, LLC (“Ignite”) or its affiliated sponsors at the time of publication. No assurance can be provided that any of the future events referenced herein (including but not limited to projected or estimated returns or performance results) will occur on the terms contemplated herein or at all. While the data contained herein has been prepared from information that Ignite believes to be reliable, Ignite does not warrant the accuracy or completeness of such information. Please see Terms & Conditions for full disclosures.

Investments in commercial real estate (CRE) involve significant risks, including market risks, interest rate risks, and liquidity risks, and may not be suitable for all investors.

Securities transactions conducted through Umergence, LLC. Member: FINRA/SIPC. Umergence is not affiliated with any entities identified in this communication.

© 2023 IGNITE INVESTMENTS, LLC