THE U.S. MULTIFAMILY MARKET’S ENDURING STRENGTH:

Long-Term Prospects Hold Strong Despite Short-Term Development Boom

February 2024

The long-term U.S. multifamily outlook remains positive as the market moves toward balance and new supply begins to ebb. The past year brought challenges to the multifamily sector, with an oversupply dampening strong demand and pressuring rents across the country. Despite this, the market edges towards equilibrium, driven by lasting demand that reinforces the sector’s attractiveness for investors.

In its Q1 2024 Multifamily Supply Forecast, Yardi Matrix states, “New construction began to slow in Q3 2023 and should continue to moderate into 2024, resulting in new supply bottoming in 2026.”1 The macroeconomic backdrop is improving too, thanks to tailwinds like a solid labor market, potentially lower interest rates, and waning inflation.

Similarly, Freddie Mac in its 2024 multifamily outlook suggests that supply challenges are nothing to lose sleep over and are short- term in nature. Meanwhile, long-term market drivers—a broader housing shortage, pricey real estate, and shifting demographics among renters—are here to stay. Market participants and investors who can read the signs have a unique opportunity to jump on the multifamily bandwagon just as the outlook is on the upswing.

THAT WAS THEN

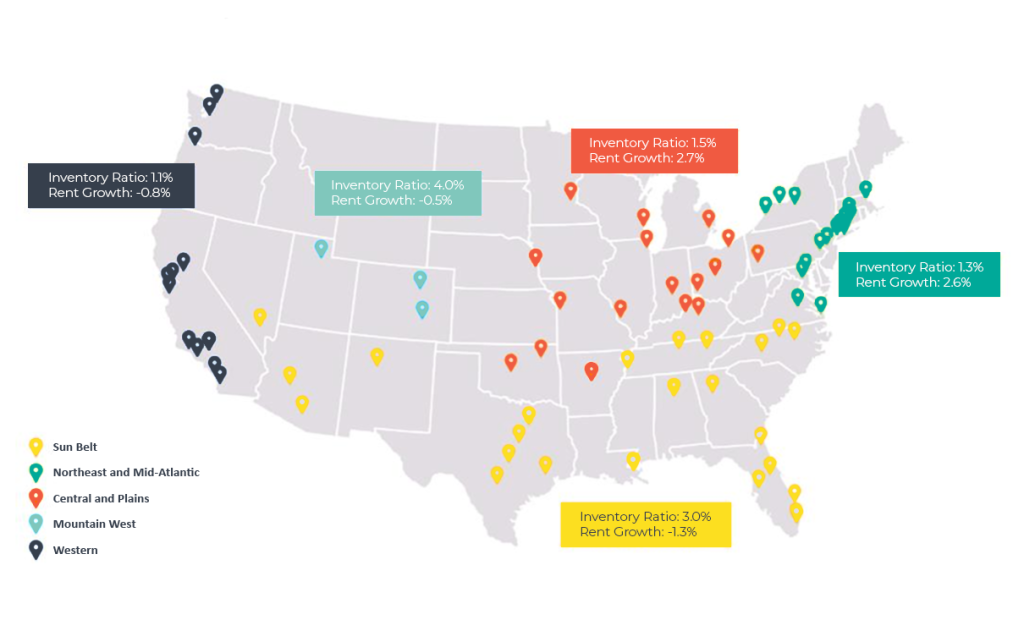

It’s not a secret that the U.S. multifamily sector experienced whiplash last year. Impressive absorptions in cities like Boston, Dallas, Nashville, Orlando, and Phoenix were met with a flood of units in the Sun Belt Region. The post-pandemic surge in demand is what initially sparked the building frenzy that developers eagerly pursued.2 As a result, vacancy rates climbed higher, reaching 7.5% by year-end 2023. However, vacancy rates increased from a low base in 2021-2022 when they were hovering at around 5.6%.3 And then historic supply hit.

(Click image to view larger)

Sources: RealPage, Freddie Mac

In 2023, 558,000 multifamily units were estimated to have been completed, volume that the market hadn’t witnessed since the 1980s.4 In response, developers strategically lowered rents to keep occupancy intact. By year-end 2023, multifamily rents managed to eke out a gain of 0.3%, according to Yardi Matrix, setting the stage for a broader recovery in the years to come as conditions improve. Among the results, Sun Belt cities Fort Lauderdale, Houston, Miami, and Palm Beach all closed out Q3 2023 with year-over-year rent growth.5

With multifamily activity forecast to slow in 2024, greater market stabilization appears to be in the cards. Demand has not wavered, with the total number of units absorbed in 2023 reaching 332,000, a 122% increase compared with year-ago levels, according to CoStar.

THIS IS NOW

Meanwhile, the supply/demand dynamic is looking up, as evidenced by a double-digit percentage drop in multifamily construction starts last year, paving the way for less robust multifamily development on the horizon. Multifamily and single-family home construction starts in 2023 sank 9% year over year to 1.41 million units; they plummeted nearly 12% compared with 2021 levels when construction starts were hovering at a 15-year high.6 In fact, some economists suggest that last year’s decline in construction starts was even more severe than the Census Bureau is letting on.7

Multifamily New Supply Forecast Q1 2024 vs. Q4 2023

(Click image to view larger)

Source: Yardi Matrix

The tide on multifamily supply and demand has already begun to turn. Industry predictions are calling for a 21% year-over-year decline in the number of apartment units added in 2024, at 440,000.4 However, supply will take some time to normalize. For example, Freddie Mac forecasts that multifamily rent growth will be positive in 2024 but fall short of “longer-run averages” because of unit deliveries. Of course, a stable interest rate environment could do wonders for deal flow. While some degree of uncertainty remains around the economy, Freddie Mac calls multifamily a “favorable asset class given the expensive for-sale market and demographic trends.”

CAPITAL MARKETS CONUNDRUM

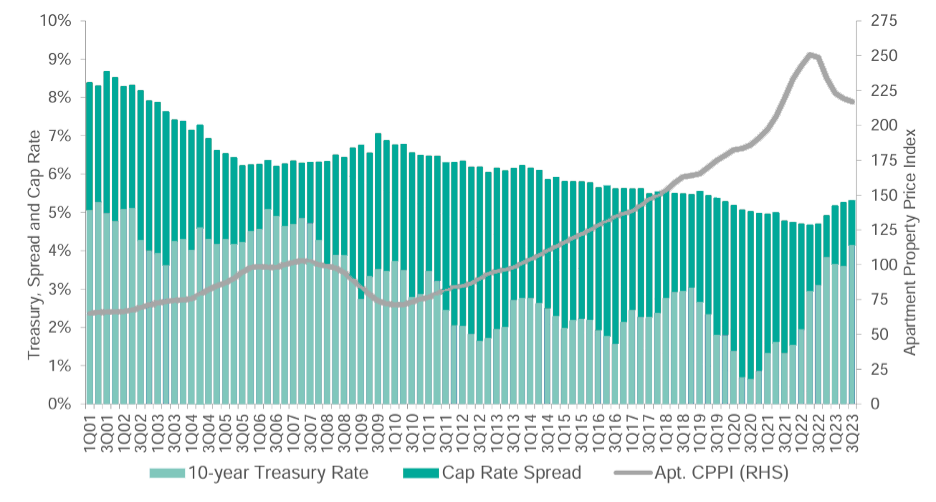

The capital markets present a wildcard to the multifamily outlook, as there is no crystal ball into how or when lenders will respond to changing market conditions; lending institutions do tend to follow a herd mentality. Nevertheless, the U.S. Federal Reserve is widely expected to make a 180-degree pivot toward dovish monetary policy this year, a loosening that has yet to occur but should eventually make its way to the debt and equity capital markets. Whenever it arrives it will be not a moment too soon.

Multifamily Price Index, Cap Rate Spread and Treasury Rate

(Click image to view larger)

Sources: Freddie Mac, Real Capital Analytics CPPI, Federal Reserve Board, Moody’s Analytics

Housing giant Freddie Mac expects that greater interest rate certainty will pave the way for greater cap rate and property value stability, which should help to bridge the gap between buyers and sellers on asset values and bolster multifamily deal volume.8 According to MSCI Real Assets data, cap rates on multifamily sales have been resilient despite the high interest rate environment, hovering at 5.3% as of Q3 2023, a 60-basis point increase year over year.9

THE TAKEAWAY

When it comes to multifamily development and investing, patience is a virtue. While 2024 might not shape up to be a year of exits, it should be one in which well positioned developers can capitalize on a shifting market landscape. Those who do will likely be rewarded later by secular tailwinds that will make multifamily investing an increasingly attractive place to be in the years to come.

1. (2024, February 9). Multifamily Supply Forecast Notes. Yardi Matrix. https://www.yardimatrix.com/publications/download/file/5072-MatrixResearchBulletin-MultifamilyForecast-Q12024?signup=false

2. (2023, December). National Multifamily Report. Yardi Matrix. https://www.yardimatrix.com/publications/download/file/4927-MatrixMultifamilyNationalReport-December2023

3. (2023, February). Multifamily vacancy rates in the United States from 1st quarter 2010 to 3rd quarter 2022. Statista. https://www.statista.com/statistics/241286/us-multi-family-rent-growth-forecast/

4. Lybik, J. (2023, November 8). Expect fewer new apartments next year after record-setting 2023. CoStar. https://www.costar.com/article/660620329/expect-fewer-new-apartments-next-year-after-record-setting-2023

5. (2024, Jan. 11). Multifamily National Report: United States. CoStar. https://product.costar.com/pds/report/3e8e783b-1af2-492f-8865-bc4e0319f22a/retrieve/blue/United%20States-MultiFamily-National-2024-01-11#view=Fit

6. Richter, W. (2024, January 18). Residential Construction in 2023: Multifamily Starts Fall from 38-Year High, single-Family Fall for 2nd Year, Both Still Higher than Pre-Covid. Wolf Street. https://wolfstreet.com/2024/01/18/residential-construction-starts-fall-in-2023-multifamily-from-38-year-high-single-family-for-2nd-year-both-still-higher-than-pre-covid/

7. Parsons, J. (2023, Nov. 21). Census is Likely Overstating Multifamily Starts in 2023. Real Page. https://www.realpage.com/analytics/us-census-starts-probably-overstated/

8. (2023, December). 2024 Multifamily Outlook. Freddie Mac. https://mf.freddiemac.com/docs/2024_multifamily_outlook.pdf?utm_campaign=General%20Investor%20Campaigns&utm_medium=email&_hsmi=2&_hsenc=p2ANqtz-9OS7jfvpf7oLAQKtmUFqWAeuf4qXDNXoCtJoaH7YU9KA3io4USI48rPdSvQDlmIhNagZb32uQHPVjXmIux5uUhJ8gXQ

&utm_content=2&utm_source=hs_email

9. (2023, Dec. 18). Multifamily Values Not Driven Solely by Rent Growth. Fannie Mae. https://multifamily.fanniemae.com/news-insights/multifamily-market-commentary/multifamily-values-not-driven-solely-rent-growth

The information contained herein is for informational and educational purposes only and is not an offer to sell or a solicitation of any offer to buy any securities. The information contained herein is not intended to and does not constitute investment, legal, or tax advice, or recommendation of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Any investment in securities involves a high degree of risk and may not be suitable for all investors and you should consult with an expert before making investment decisions. The views or opinions expressed herein represent those of Ignite Investments, LLC (“Ignite”) or its affiliated sponsors at the time of publication. No assurance can be provided that any of the future events referenced herein (including but not limited to projected or estimated returns or performance results) will occur on the terms contemplated herein or at all. While the data contained herein has been prepared from information that Ignite believes to be reliable, Ignite does not warrant the accuracy or completeness of such information. Please see Terms & Conditions for full disclosures.

Investments in commercial real estate (CRE) involve significant risks, including market risks, interest rate risks, and liquidity risks, and may not be suitable for all investors.

Securities transactions conducted through Umergence, LLC. Member: FINRA/SIPC. Umergence is not affiliated with any entities identified in this communication.

© 2023 IGNITE INVESTMENTS, LLC