GREEN SHOOTS

OF RECOVERY

August 2023

The U.S. Economy has reached a critical juncture, one in which the tide is finally beginning to turn, potentially altering the landscape for the rest of 2023 and into 2024. While there is still uncertainty, the latest spate of data suggests a clear shift in sentiment, particularly around inflation and interest rates, among economists and policymakers alike. As the markets seek to interpret the chatter, one thing seems clear – the economy is eyeing a fresh cycle, one in which whispers of a recession have been silenced by green shoots of an early recovery.

In recent days, JPMorgan chief economist Michael Feroli predicted the chances of the economy falling into a recession in the final quarter of the year are now slim to none, backpedaling on the firm’s previous forecasts for a late-year contraction.1

While there is reason to be optimistic, it’s important to caution that there could still be some choppy seas to navigate up ahead, not least due to the proximity of Fed Chairman Jerome Powell’s hand to the interest rate hot button after 11 rate hikes since the end of Q1 2022.

Nevertheless, a mixed bag of data across inflation, the labor market and economic expansion has managed to defy physics, giving policymakers on both the dovish and hawkish sides of the isle plenty to debate. On the one hand, consumer prices have shown repeated signs of easing while Q2 GDP grew at a faster pace than had been expected.2 On the flip side, the employment market could use some coaxing, while an unexpected jump in supplier price serves as a stark reminder of how stubborn inflation can be.

From the looks of it, the U.S. could be ushering in what’s known as a coveted Goldilocks economy – one that is neither too hot nor too cold in nature – conditions that would benefit commercial real estate. For example, this environment could be reflected in stronger asset values, cash flow, deal flow and more. If you ask Wharton Professor Jeremy Siegel, the Goldilocks economy is a fairy tale that from his expert bird’s eye view is currently coming true.3

GOLDILOCKS ECONOMY

In recent media rounds, Siegel argued that a Goldilocks economy has arrived — one comprising a growing economy, cooling inflation, and good labor market with runway for improvement. Any data that says otherwise, the famous professor argues, can be blamed on a lag effect that has yet to be reflected in the key indicators, like how the Fed in the wake of the health crisis didn’t pick up on the reality of inflation until it was too late, e.g., the transitory misfire.

(Click image to view larger)

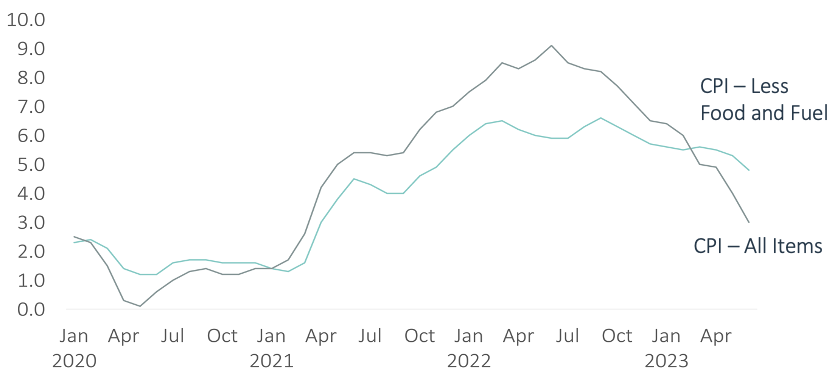

Sources: U.S. Bureau of Labor Statistics. Image by the CBS News.5

Importantly, Siegel doesn’t expect inflation to rear its ugly head again anytime soon, despite any lagging economic indicators that might suggest otherwise. With a modest uptick of 3.1% in July’s Consumer Price Index (CPI) report, Siegel’s theory may just have legs. Among the inflation drivers were shelter costs, up 7.7% vs. year-ago levels.

It’s been over a year since the economy hit peak inflation of 9.1%, and fortunately that level remains in the rearview mirror4. Now the narrative has finally shifted from how high interest rates can climb to how long policymakers can hold their collective breath and pause – until the pendulum eventually swings in the opposite direction.

With interest rates currently hovering in the 5.25%-5.50% range, holding also means that they will remain elevated for a while, though a reversal might be closer than many think: economist rumblings of rate cuts in 2024 have begun to surface.

FED POLICYMAKER ROUNDUP

New York Fed President John Williams, a lone wolf on monetary policy, is confident that underlying inflation is headed for 2.5%-2.75% territory by year end – fueled by easing shelter inflation – a mere stone’s throw from the central bank’s 2% inflation target.6 If he’s right, convictions of a Goldilocks economy could become more widespread.

- Headline Inflation: Reflects changes in prices across categories.

- Core Inflation: Excludes food and energy prices, which tend to be volatile.

- Shelter Inflation: A major influence in the CPI, shelter inflation reflects changes in consumer spending on rental housing (not home prices).

Philadelphia Fed President Patrick Harker has hinted that barring any “alarming” economic data, he and his peers can “be patient” and “hold rates steady,” though he doesn’t anticipate rate cuts anytime soon.7 Atlanta Fed President Raphael Bostic,8 one the other hand, told Reuters his “baseline outlook” could contemplate cuts in H2 2024 but not any sooner.

To be fair, not all policymakers are quite as sanguine, with Fed Governor Michelle Bowman9 refusing to rule out another rate hike to tame unwieldy inflation down to the 2% target. However, if the CPI can maintain the low 3% range, the argument for more rate hikes loses steam.

Jack Ablin, investment chief at Cresset Capital, recently told CNBC that the Fed’s next move is dependent on the CPI. He expects that interest rates will be in a holding pattern for a while, observing potential rate cuts on the horizon in mid-2024.

One potential, though admittedly farfetched, tailwind is the sudden resignation of Fed member James Bullard, a monetary policy hawk and strong proponent of interest rate hikes, who is stepping down in mid-August, possibly tipping the scales to the dovish side. Nevertheless, there is no shortage of other hawkish policymakers who could easily serve as his replacement.

CRE IN FOCUS

It’s undeniable that the economy has thrown the CRE market curveballs of late given the Fed’s aggressive interest rate campaign that started in early 2022. While fixed-rate debt has served Ignite’s investors well, variable rates have been a thorn in our side and there’s no denying the impact that hawkish monetary policy has had on the macro picture. Now that inflation appears to be taming, there is a fresh wind of cautious optimism in the air.

Ignite Investments Managing Principal Nili Jaisinghani explained the dynamic between cap rates and a potentially lower interest rate environment, hedging her remarks by noting that it’s “anybody’s guess” as to what the Fed will do.

“As interest rates and cap rates are connected, it is no secret that the value of our assets will be aided in the lowering of rates. In the cases where we have variable rate debt, the lowering of interest rates will have an immediate effect on cash flow. The lowering of rates will also affect transaction volume.”

She went on to share how in today’s market, both debt and equity have been hard to come by, requiring market participants to remain nimble at every turn.

“In this environment it is not just about investing in good assets. The capital structure of each individual asset matters, as well the strength of your sponsor to hold and possibly fund capital/cash needs through a tough environment.”

– Nili Jaisinghani, Managing Principal, Ignite Investments

As capital raisers for commercial real estate, we are staying opportunistic while also exercising prudence and remaining patient where it makes sense.

“In some cases, we are on the sidelines waiting and in others we are forging ahead. I can speak more to the cautious mindset that we have when evaluating investments, but I would argue we have always been extremely cautious when selecting what to invest in no matter what stage of the cycle we are in. The difference now being there are other factors that weigh more heavily in the consideration set that might not have been a larger topic of conversation five years ago,” shared Nili.

LABOR AND COMMODITIES MARKETS ARE WILDCARDS

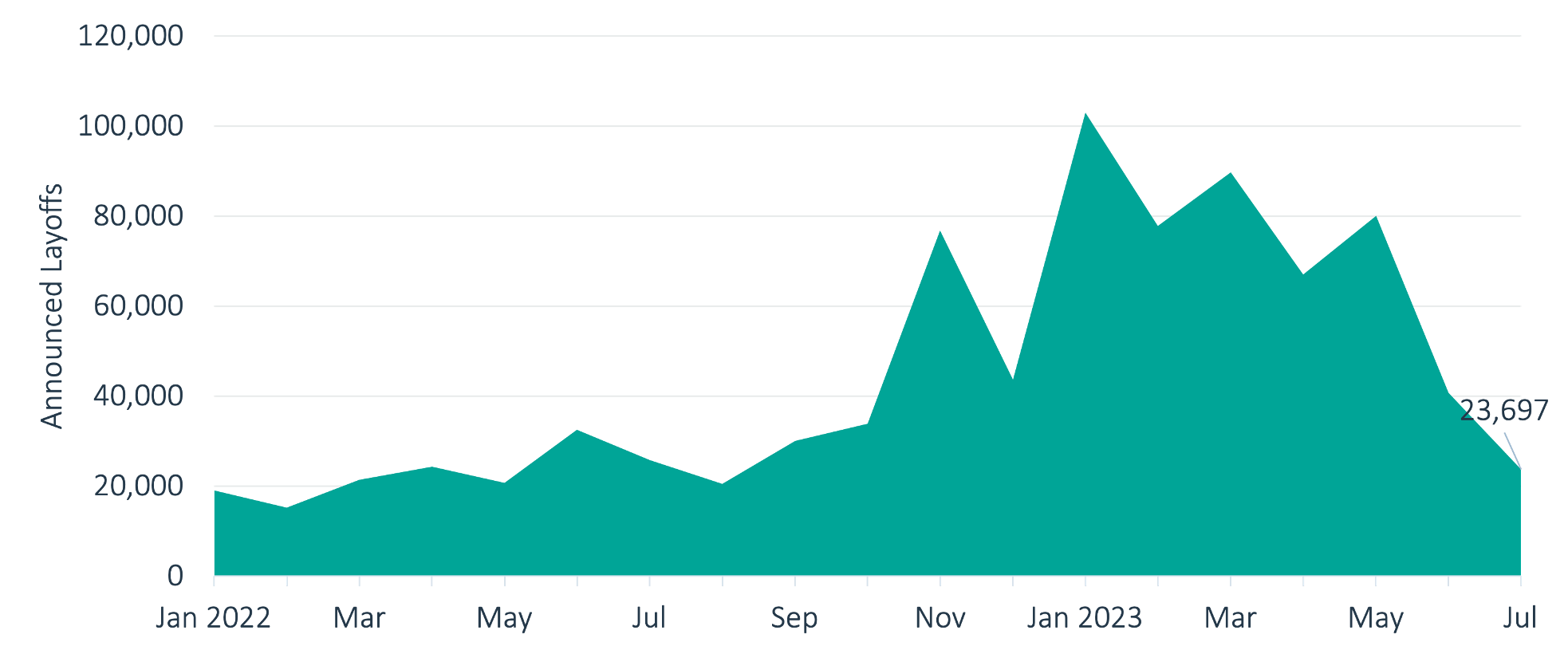

Here’s the rub: the labor market is sending out mixed signals to monetary policymakers. On the one hand, layoffs have fallen to their lowest level in nearly a year, according to a report by Challenger, Gray and Christmas,10 bucking the trend of any perceived weakness. In addition, wages have been inching higher and as of last month are up 4.4% vs. year-ago levels. But according to Seigel, wages remain in catch-up mode and are not the driver of inflation here.

However, with 187 non-farm payrolls added to the economy in July,11 a rosy outlook was undercut by fewer jobs entering the economy than anticipated. This outlier in juxtaposition with the other data is further evidence that the economy is not overheating. As a result, it’s quite possible that the Fed will view this semi-weakness as sufficient reason to suspend its interest rate hike campaign in favor of producing a stronger jobs market. Only time will tell.

The labor market isn’t the only one painting a murky picture. There is a correlation between high oil prices and inflation, so a recent rally in oil prices is something to keep an eye on. With the price of Brent Crude oil hovering at over $80 per barrel, levels it hasn’t seen since early 2023, there’s no telling how long this pattern will persist. If lofty commodity prices persist, and the economy begins to operate on all cylinders, the markets may wager that higher interest rates will be the result. However, this hand is still being dealt and the cards are held close to the vest.

(Click image to view larger)

Source: Costar; Challenger, Gray, and Christmas; as of August 2023.

THE TAKEAWAY

The U.S. economy’s prognosis is not set in stone. There are no promises on interest rates, and there are market forces at work that are outside of our control. However, the economy is clearly evolving, giving us reason for cautious optimism on the long-term outlook. Over the next six to eight months, we will be looking for further evidence that inflationary clouds have begun to dissipate while listening for any variance in tone from the Fed on interest rates.

Fortunately, Ignite exclusively partners with sponsors with strong track records who have effectively managed investments through market cycles. In this current cycle, we are encouraged by the positive data and fully expect that commercial real estate market conditions will increasingly reflect these promising trends, the risk of rates staying high for a long time or rising notwithstanding.

1. Cox, J. (2023, August 4). JPMorgan Backs Off Recession Call Even With ‘Very Elevated’ Risks. https://www.cnbc.com/2023/08/04/jpmorgan-backs-off-recession-call-even-with-very-elevated-risks.html#:~:text=Power%20Lunch-,JPMorgan%20Chase%20economists%20on%20Friday%20bailed%20on

%20their%20recession%20call,a%20soft%20landing%20is%20possible

2. Cox, J. (2023, July 27). GDP grew at a 2.4% pace in the second quarter, topping expectations despite recession calls. CNBC. https://www.cnbc.com/2023/07/27/gdp-q2-2023-.html

3. [CNBC Television]. (2023, July 14). Wharton Professor Jeremy Siegel: Here’s why the Fed should stop raising rates [Video]. YouTube. https://youtu.be/5IM6jfwC7gg

4. Siegel, R. (2022, July 13). June inflation soared 9.1%, a new 40-year high, amid spiking gas prices. The Washington Post. https://www.washingtonpost.com/business/2022/07/13/inflation-june-cpi/

5. Ivanova, I. (2023, July 26). Federal Reserve hikes key interest rate to highest level in 22 years. CBS News. https://www.cbsnews.com/news/federal-reserve-hikes-interest-rate-to-22-year-high-july-2023/

6. Smialek, J. (2023, August 7). The New York Fed president sees interest rates coming down with inflation. The New York Times. https://www.nytimes.com/2023/08/07/business/economy/john-williams-new-york-fed-transcript.html

6. Cox, J. (2023b, August 8). Philadelphia fed president Patrick Harker suggests interest rate hikes are at an end. CNBC. https://www.cnbc.com/2023/08/08/philadelphia-fed-president-patrick-harker-suggests-interest-rate-hikes-are-at-an-end.html

8.Saphir, A. (2023, August 1). US fed officials see pathway to soft landing. Reuters. https://www.reuters.com/markets/us/feds-goolsbee-says-he-is-closet-inflation-optimist-2023-08-01/

9.Thomson Reuters. (2023, August 7). Fed officials sketch case on both sides of rate debate. Reuters. https://www.reuters.com/markets/rates-bonds/feds-bowman-more-rate-hikes-likely-needed-bring-inflation-target-2023-08-07/#:~:text=Aug%207%20(Reuters)%20%2D%20The,to%20do%20another%20rate%20increase%3F

10. Challenger, Gray & Christmas, Inc. (2023, August 2). Job cuts fall to lowest point in 11 months in July 2023; YTD cuts up 203%, hiring down 83% yoy. Challenger, Gray & Christmas, Inc. https://www.challengergray.com/blog/job-cuts-fall-to-lowest-point-in-11-months-in-july-2023-ytd-cuts-up-203-hiring-down-83-yoy/

11. Mutikani, L. (2023, August 4). US job growth slowing, but wage gains remain strong. Reuters. https://www.reuters.com/markets/us/us-job-growth-remains-moderate-july-wage-gains-still-strong-2023-08-04/#:~:text=WASHINGTON%2C%20Aug%204%20(Reuters),tightness%20in%20labor%20market%20conditions.

The information contained herein is for informational and educational purposes only and is not an offer to sell or a solicitation of any offer to buy any securities. The information contained herein is not intended to and does not constitute investment, legal, or tax advice, or recommendation of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Any investment in securities involves a high degree of risk and may not be suitable for all investors and you should consult with an expert before making investment decisions. The views or opinions expressed herein represent those of Ignite Investments, LLC (“Ignite”) or its affiliated sponsors at the time of publication. No assurance can be provided that any of the future events referenced herein (including but not limited to projected or estimated returns or performance results) will occur on the terms contemplated herein or at all. While the data contained herein has been prepared from information that Ignite believes to be reliable, Ignite does not warrant the accuracy or completeness of such information. Please see Terms & Conditions for full disclosures.

© 2023 IGNITE INVESTMENTS, LLC