LOOKING AHEAD TO IGNITE’S 2022 PLATFORM

January 2022

As we look toward 2022, we turned to the experts to weigh in on key macroeconomic trends that will likely shape the opportunities on Ignite’s platform over the coming year.

On the heels of the Federal Open Market Committee (FOMC) January meeting that left much to speculation, 2022 has us focused on three main economic concerns that will ultimately drive industry performance: labor, interest rates, and inflation.

Amidst “The Great Resignation,” the unemployment rate is approaching “full employment” levels. Experts are anticipating total employment to recover to pre-pandemic levels by the end of the year, closing the 4.2 million jobs gap versus its pre-recession peak. Yet labor shortages are expected to persist through 2022, an ongoing concern for commercial real estate operators and developers, with labor and subsequent supply constraints posing the greatest challenge for the industry.

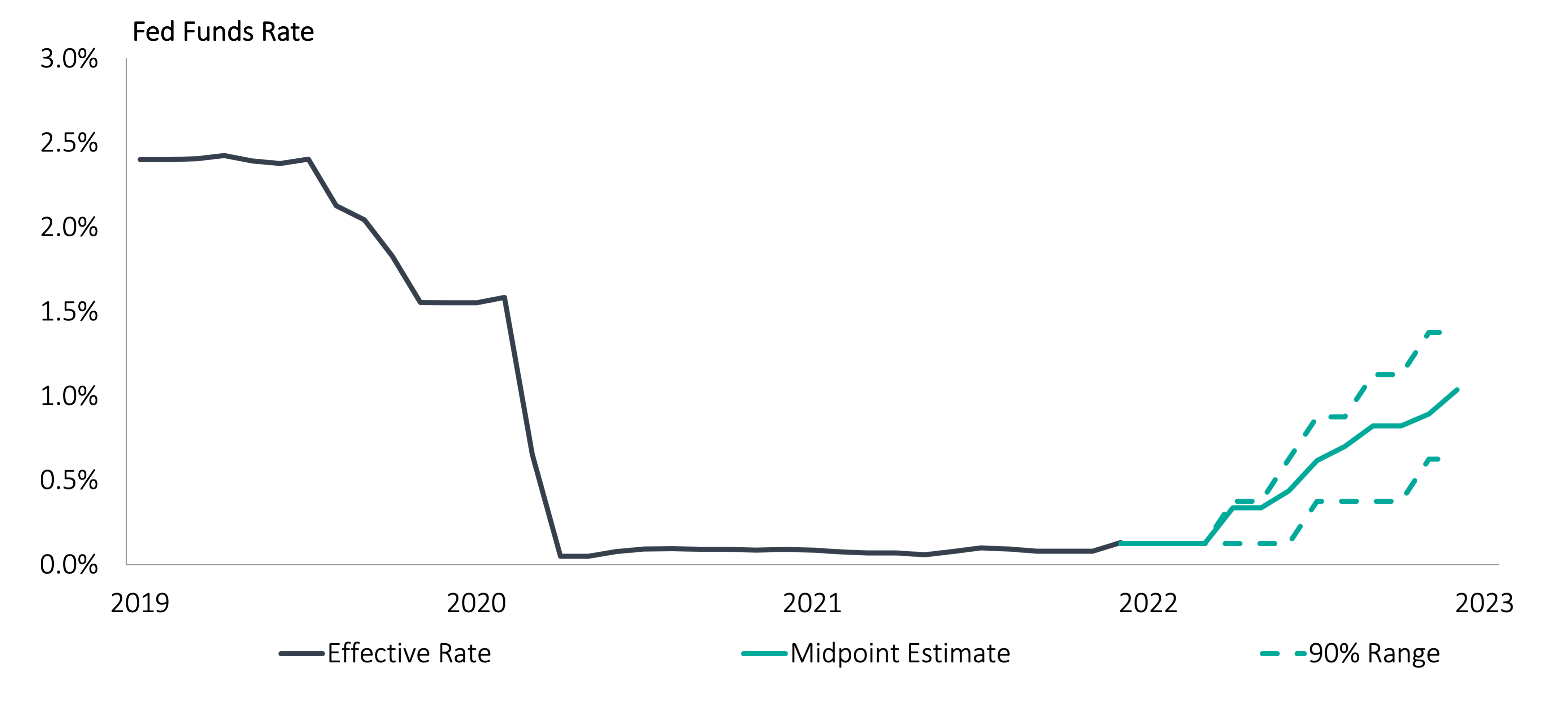

As the labor market recovers and inflation pressures persist, the U.S. Federal Reserve (the “Fed”) announced it will raise interest rates from the zero lower bound throughout 2022, with the first of these increases in March, moving away from its accommodative monetary policy. According to Fed Chair Jerome Powell, “There’s quite a bit of room to raise interest rates without threatening the labor market.” As the FOMC considers the right balance between a drastic hike that would risk labor recovery and a too-slow hike that would not moderate inflation, the market has assigned an 88% chance of the target rate increasing to 25-50 basis points following the FOMC’s March meeting.¹

FED FUNDS RATE AND MARKET IMPLIED RATE FORECAST

Sources: CME Group; Bureau of Labor Statistics; U.S. Treasury Department; CoStar Advisory Services as January 2022

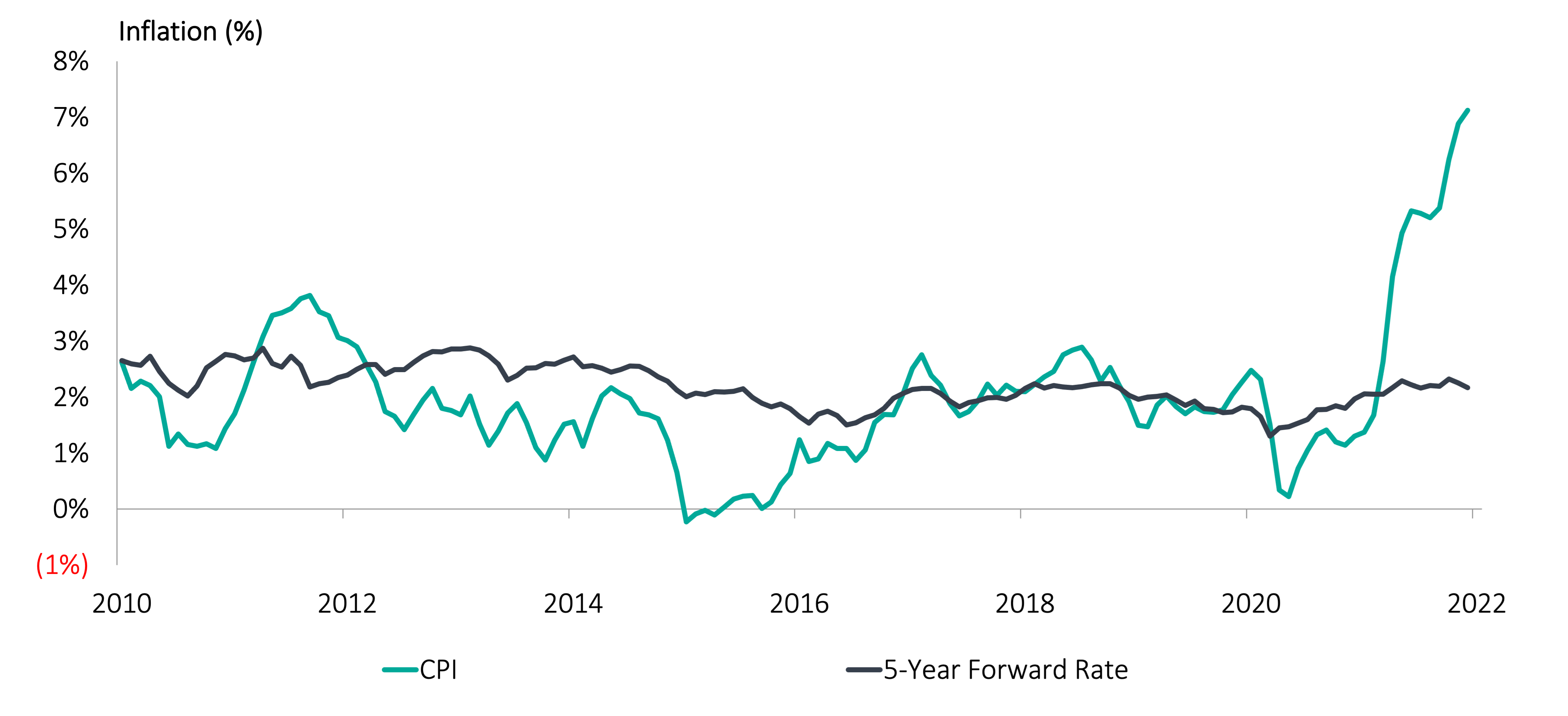

Inflation has risen to a multi-decades high, as a confluence of supply-chain disruptions and surging demand drive up prices. As Chairman Powell noted, “These problems have been larger and longer lasting than anticipated, exacerbated by waves of the virus.” While inflation is forecasted to be lower in the second half of 2022, the experts expect it will ultimately remain above the Fed’s goal of 2%, particularly in light of its ongoing steady increase since the FOMC last met in December 2021. While they have not specified their plans, the Fed anticipates improving the supply chain and is prepared for quantitative tightening with a fiscal policy that will be “less supportive of growth” and focused on the real economy. According to Chairman Powell, “There are multiple forces which should be working over the course of the year for inflation to come down.”

CPI INFLATION RATE AND 5-YEAR FORWARD RATE

Sources: Bureau of Labor Statistics; U.S. Treasury Department; CoStar Advisory Services as of January 2022.

As the economy continues to strengthen throughout 2022, we can expect subsequent growth in commercial real estate investing. While prognosticators are not discounting the concern of decades-high inflation and the likelihood of rising interest rates, the strong economic recovery and inflation pressures should lead to the end of the Fed’s quantitative easing, setting the stage for a modest increase in interest rates which should not disrupt property markets.

AN INTERVIEW WITH OUR FEATURED SPONSOR

Given its proven track record, the in-depth due diligence of Ignite’s featured sponsor, Encore Enterprises, plays an integral role in developing our investment platform. Since 1999, Encore has effectively managed through various market cycles.

With more than 30 years of experience investing in commercial real estate, Encore’s Chairman and CEO, Bharat Sangani, MD (“Doc”), employs a disciplined strategy that weighs macroeconomic factors. As Doc looks ahead to 2022, he explores how the greatest market influencers of the past year – the pandemic and inflation – are expected to affect Encore’s investment decisions.

Scientifically, the pandemic is evolving into an endemic, with the mortality rate of omicron on par with the flu. The virus in some form or other will never fully disappear; however, assuming new strains are no more severe than omicron for the increasingly vaccinated population, Doc anticipates a return to normalcy before the end of the year. The population’s ongoing reaction to the virus will dictate the speed of recovery and he expects that the economy will return to 2019 levels by Q4 of 2022 as more people reach their “fatigue point.”

“I have always believed inflation is not transitory and consumer confidence is what truly drives the economy.” According to Doc, economic growth ultimately depends on the employment rate and interest rates. With jobs currently plentiful, unlike during most recessionary periods, interest rates will have the greatest impact on the economy, with an increase of up to 150 basis points effectively slowing down the economy and helping curb inflation. Provided there is no significant global instability and no further government intervention creating artificial wealth through stimulus, Doc expects to see an easing of the economy by Q2 2023.

Encore is well-positioned to have another strong year with plenty of deals in the pipeline. Its path is very clear: focus on what Encore does best. The company will continue to invest in operating businesses that generate consistent cashflow despite market instability, as well as multifamily developments and value-add acquisitions with strong upside potential in both the hospitality and multifamily sectors. As the year progresses, Doc anticipates taking advantage of opportunities outside of his team’s core expertise through co-GP partnerships with high-performing boutique firms in complementary verticals.

With the ongoing support of Ignite investors, Doc is confident Encore will continue to pave the path forward as they have for the past 20 years.

ENCORE MULTIFAMILY

Charlie Keels is the President of Encore Multifamily and has led his team in record-setting transactions in 2021. He considers increasing competition, rising costs, and the dynamic rental market as he evaluates each deal in his pipeline.

With so much dry powder in the market, competition is fierce and it is truly a seller’s market. The spread between exit pricing and replacement cost is increasing to historic levels, and the price of land is adjusting to the influx of buyers. Despite increasing development costs, fundamentals are strong. Homeownership is becoming less affordable, creating greater demand for rental units and the need for additional supply, with rents in turn adjusting upward to balance rising construction costs.

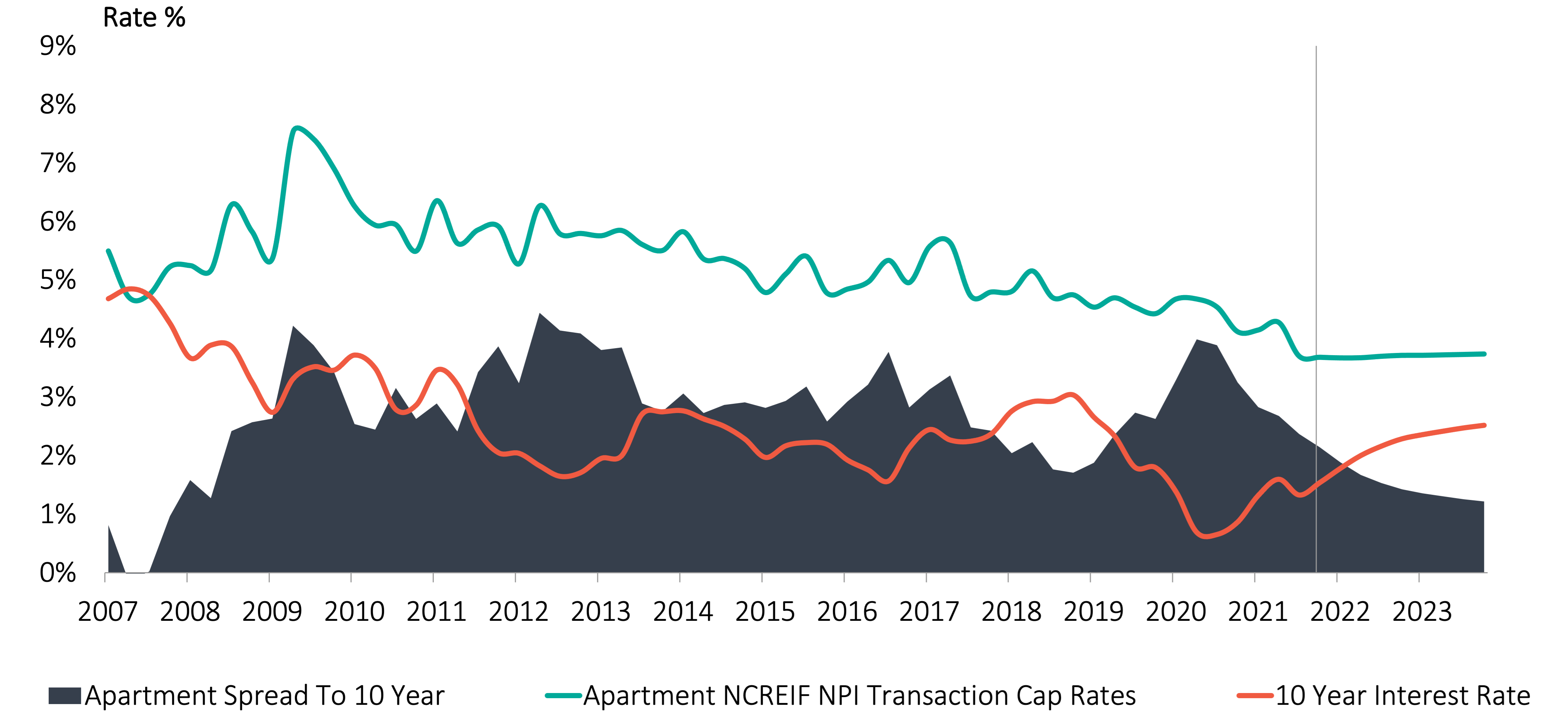

As Charlie looks ahead into the year, he is optimistic that cap rates will hold steady at less than 4%, barring any drastic increases in interest rates. Notwithstanding, he expects rents to rise with interest rates and for strong demand to continue to push pricing up, generating higher Net Operating Income (“NOI”). Although cap rates typically follow the direction of interest rates, Charlie anticipates that NOI will be more influential in the short term.

CAP RATE, TREASURY, AND SPREAD

Sources: Oxford Economics; NCREIF; CoStar Advisory Services as of Q3 2021.

Encore will continue to focus on development, particularly throughout the Sun Belt, relying on its strong network to purchase land before it is listed publicly in markets exhibiting high risk-adjusted returns. Encore will also continue to identify strong opportunities in the value-add acquisition space.

ENCORE HOSPITALITY

Glenn Pedersen is the President of Encore Hospitality and has led his team in successfully managing Encore’s hotel portfolio with minimal interruption throughout the pandemic.

Glenn’s focus for Encore’s hotel portfolio has been on operations, working to keep expenses low while strategically pushing average daily rates to where occupancy will remain stable, resulting in top-ranking RevPAR indices for most of Encore’s hotels. Despite nearly $200,000 in cancellations due to omicron alone and the lack of corporate travel, Encore’s properties have remained competitive, many reaching nearly 90% of 2019’s performance, with extended stay hotels outperforming most others.

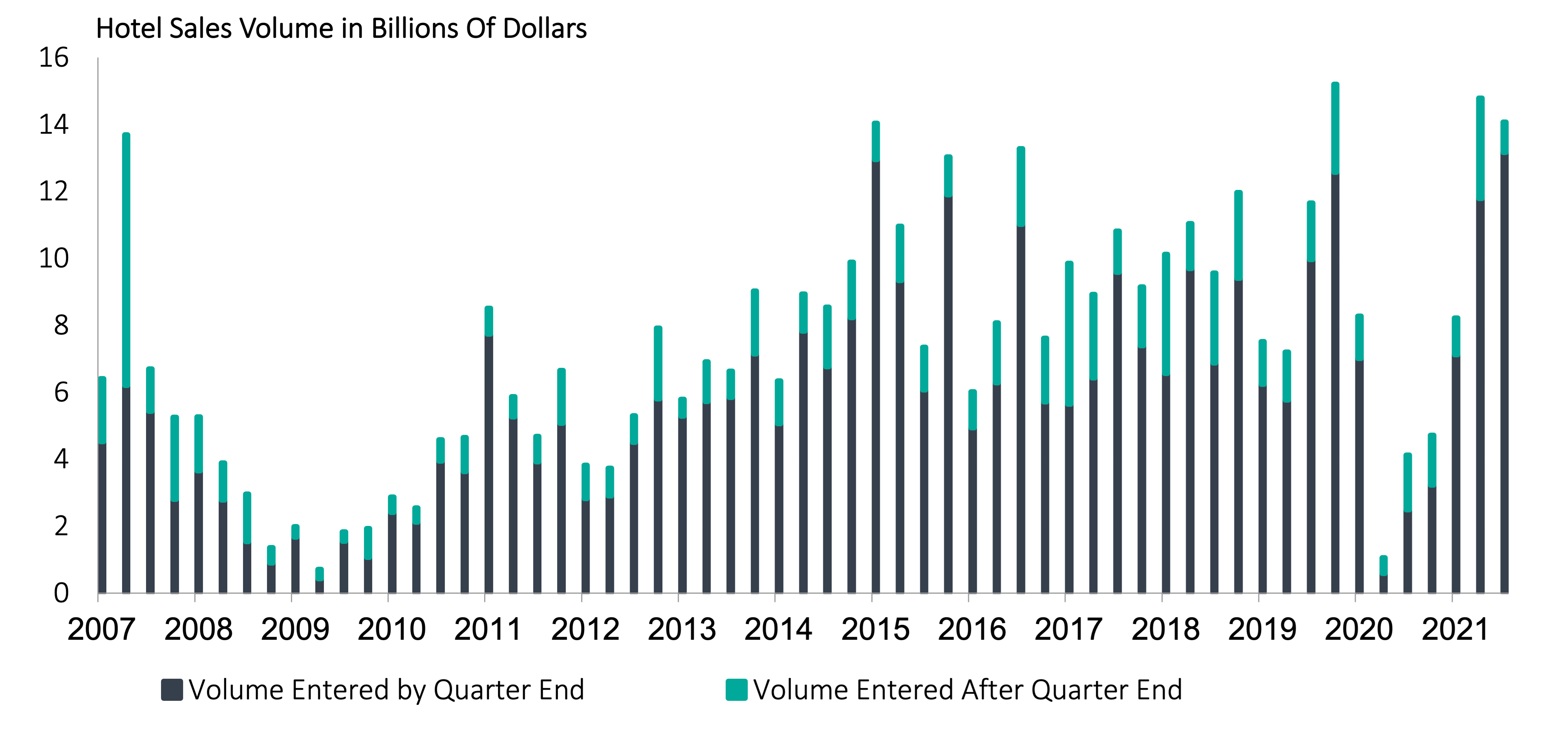

As Glenn continues to manage through the market instability, he and Doc intend to take advantage of record-high hotel sales volume, maximizing profits for investors in Encore’s outperforming assets. While excess dry powder typically results in more profitable exits, the competition driving up sale prices creates a challenge in growing Encore’s portfolio. In response, the team has taken a flexible approach in searching for new assets, taking advantage of Encore’s deep network in non-gateway markets throughout the U.S., as well as exploring partnerships with managers who have access to unique hotel opportunities.

U.S. HOTEL SALES VOLUME OVER TIME

Sources: STR; CoStar Advisory Services as of October 2021.

COMMERCIAL REAL ESTATE INVESTING IN 2022

Commercial real estate investing is approaching record highs as a result of strong investor demand and abundant capital flows. Buoyed by low-cost financing and an influx of capital availability, total investment volume is expected to continue its upward trajectory into 2022, on track to roughly equal pre-pandemic volumes from 2019 (currently the highest annual growth on record). According to CBRE, multifamily and industrial will likely continue to garner the most investor interest generating growth of 10%-15% over 2021 levels, with office and retail volumes at 5%-10%. Hotel investment volume had recovered to pre-pandemic levels at the end 2021, a positive sign for the sector in 2022.²

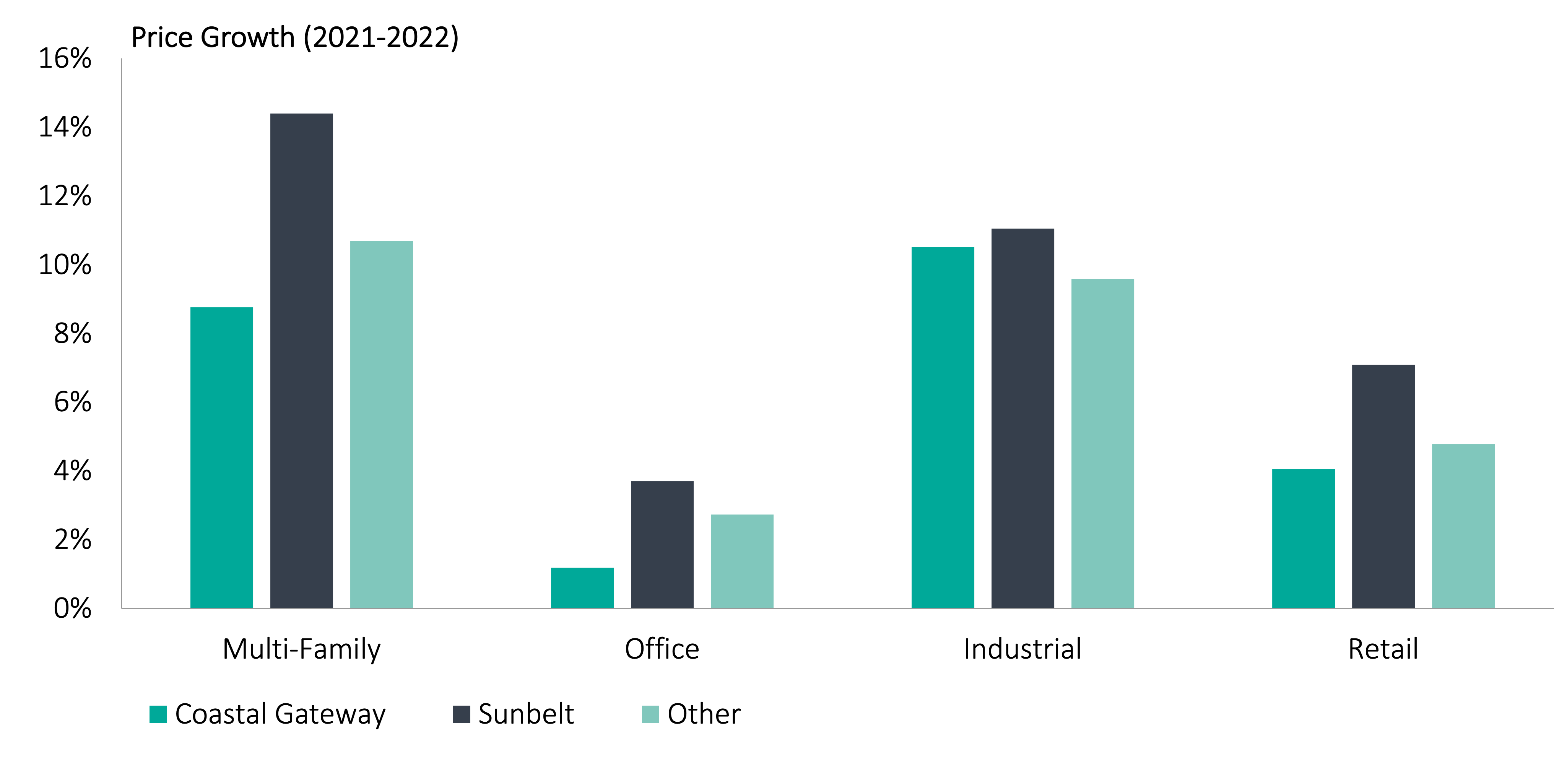

YEAR-OVER-YEAR PRICE GROWTH BY

MARKET TYPE AND PROPERTY TYPE

Source: CoStar Advisory Services as of Q3 2021.

Dry powder in North American commercial real estate currently stands at $200 billion and is expected to continue to rise through 2022. As investors continue to favor commercial real estate for its healthy returns and inflation hedging capabilities, Ignite’s dedication to providing access to top-tier opportunities and ongoing education will be the basis for our well-vetted pipeline throughout 2022.

Source for market data: CoStar Analytics; CoStar Group 2022 Global Predictions White Paper, January 5, 2022, unless otherwise noted.

Source for Federal Open Market Committee January 2022 meeting details: https://www.federalreserve.gov/newsevents.htm

COSTAR RESEARCH

The forward-looking information prepared by CoStar Realty Information, Inc. (Licensor) and presented herein is based on information from public and proprietary sources, as well as various assumptions concerning future events that are uncertain and subject to change without notice. Actual results and events may differ materially from those expressed or implied by the Licensor data presented. All Licensor data contained herein speaks only as of the date referenced, may have materially changed since such date, and is provided “as is” with no guarantee or warranty of any kind. Licensor has no obligation to update any of the Licensor data contained herein. None of the Licensor data contained herein should be construed as investment, tax, accounting or legal advice. The Licensor data contained herein speaks only as of the date referenced, may have materially changed since such date, and is provided “AS IS” with no guarantee or warranty of any kind, either express or implied. Licensor has no obligation to update any of the Licensor data contained herein. None of the Licensor data contained herein should be construed as investment, tax, accounting or legal advice.

IMPORTANT DISCLAIMER

The information contained herein is for informational and educational purposes only and is not an offer to sell or a solicitation of any offer to buy any securities. The information contained herein is not intended to and does not constitute investment, legal, or tax advice, or recommendation of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Any investment in securities involves a high degree of risk and may not be suitable for all investors and you should consult with an expert before making investment decisions. The views or opinions expressed herein represent those of Ignite Investments, LLC (“Ignite”) or its affiliated sponsors at the time of publication. No assurance can be provided that any of the future events referenced herein (including but not limited to projected or estimated returns or performance results) will occur on the terms contemplated herein or at all. While the data contained herein has been prepared from information that Ignite believes to be reliable, Ignite does not warrant the accuracy or completeness of such information. Please see Terms & Conditions for full disclosures.

© 2022 IGNITE INVESTMENTS, LLC