PRIVATE EQUITY INVESTORS GROW RESTLESS AMID MOUNTAIN OF DRY POWDER

Investors are anxiously awaiting the deployment of trillions of dollars in private equity dry powder, but there is a tug of war between distressed and high-quality assets.

December 2023

A restlessness has set in among investors who recognize that the window of opportunity for private equity to move off the sidelines and into the market is narrowing. After a period of uncertainty in which deal flow was cut off, there appears to be a calm before the storm in private equity. Once that deal spigot is flowing once again, fund managers are likely to be vying for the very same deals on which they previously waited.

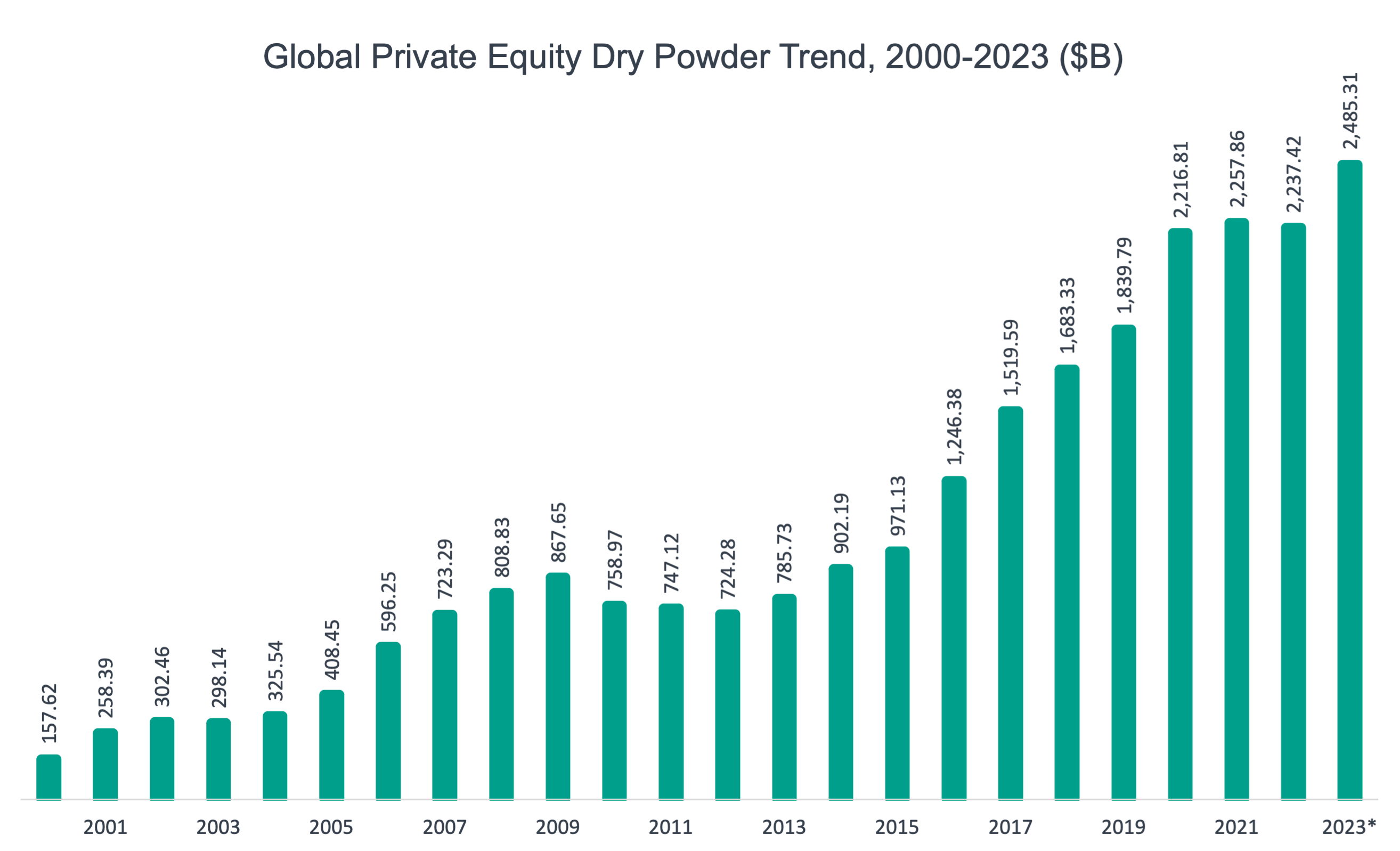

For now, private equity is sitting on a massive amount of dry capital amid what has become a dearth of deal flow, with private equity entry deals falling over 20% in Q3 2023 compared with Q2 levels. Meanwhile, private equity dry powder, or cash committed by investors waiting to be deployed, ballooned to an all-time high of $2.49 trillion globally as of mid-2023, up more than 11% compared with year-end 2022 totals, according to S&P Global.1

(Click image to view larger)

Data compiled July 3, 2023. Analysis includes aggregate dry powder of global private equity funds with vintage year between 2000 and 2023. Dry powder data is supplemented by Preqin. Source: S&P Global Market Intelligence.

It’s a trend that has spilled over to commercial real estate, too. U.S. real estate assets under management (AUM) in 2022 grew to nearly $1 trillion, setting a record and representing 66% of global real estate AUM. Of that amount, more than $284 billion in assets takes the form of committed but uncontributed capital.

Indeed, a tumultuous dealmaking backdrop in which buyers and sellers have been far apart on asset valuations has left many private equity players on the sidelines in 2023, but perhaps not for much longer.

PUTTING MONEY TO WORK

Investors are eager to see their money put to work amid an expectation that the industry is on the brink of some promising vintage years ahead for deploying capital in asset classes like commercial real estate.2 Consequently, that mountain of dry capital could be about to move even before the clouds of market uncertainty clear.

For example, with so much capital sitting on the sidelines, private equity funds are likely to feel pressure from liquidity-hungry investors to deploy it. This will especially hit home for those managers who want to bring new funds to market for which they’ll need to raise additional rounds of capital. Fund managers face the risk that investors will forego the commitment of fresh capital until funds sitting on the sidelines have been deployed.

Andrea Guerzoni, global vice chair for strategy and transactions at EY, suggests there is a growing urgency among investors and fund managers alike to put money to work despite market challenges that are beyond their control.3 Fund managers have begun to realize that they must “operate under the circumstances,” explained Guerzoni, adding that he would like to see PE managers take a more proactive approach to dealmaking despite the high interest rate environment.

Fortunately, the Federal Reserve has held back from raising interest rates any further in Q4, and conditions don’t appear to be worsening, hinging on asset debt maturity and terms. By all counts, the U.S. economy has averted a recession. Meanwhile, economists and policymakers are starting to believe that rate cuts may be on the horizon in the first half of 2024.

Of the private equity deals that have been completed in 2023, a rising percentage of them have been growth equity transactions, comprising over 22% of total U.S. PE deals as of June, close to an all-time high, according to Pitchbook data.4 Growth equity transactions tend to command smaller check sizes and debt compared with buyout strategies, a catalyst for deal selection in a challenging financing environment.

DISTRESSED ASSETS

With $205 billion in dry powder, the U.S. commercial real estate industry is experiencing deployment challenges of its own. There is an estimated $1.5 trillion in commercial real estate debt poised to come due by year-end 2025, as per Morgan Stanley data. These maturities are likely to be met with higher interest rates and tighter liquidity standards than before. As a result, much of that private equity dry capital could make its way to distressed real estate, or perhaps private credit, another trend that has caught on of late. BlackRock predicts that the private credit market is poised to grow to $3.5 trillion by 2028 compared with $1.6 trillion in 2023, as per Preqin data.5,6

Meanwhile, many commercial real estate investors are champing at the bit, targeting value-add and opportunistic strategies over core and core plus in this market amid a willingness to accept greater risk in exchange for potentially higher returns. Market participants are awaiting a surge in stressed assets but have yet to see if and when this will actually happen.

“[Investors are] anticipating more distress — if not distress, dislocation — in the market and expecting that the next couple of years are going to be good vintage years for deploying capital,” stated Douglas Weill, founder and co-managing partner of Hodes Weill & Associates, cited by Commercial Property Executive.7

However, stressed properties where debt is at risk of default are neither every investor’s nor every private equity manager’s cup of tea. Plus, with the rise of private credit, a trend in which private equity firms flush with capital fill in the lending gap left by banks, there may be fewer defaults than expected. Fortunately, there are still high-quality assets in the market from which private equity managers can choose.

FLIGHT TO QUALITY

On the other side of the spectrum, the private equity market is also experiencing a heightened focus on quality among GPs and LPs alike. Despite dealflow and the number of private equity funds in the market sinking, LPs have not abandoned ship. Instead, there appears to be a flight to quality unfolding in which LPs are returning to crème de la crème funds with proven histories, reupping their capital commitments to fund managers with whom they already known and trust.8

In today’s challenging market environment, emphasizing sponsor relationships is more critical than ever. Only those sponsors with proven strategies, a disciplined approach, and seasoned management teams will be able to successfully navigate the steep market terrain. As a result, investors are choosing to return to strong sponsors that are able to uncover opportunities and put LPs first even in the face of broader market uncertainty.

TAKEAWAY

Private equity can’t stay on the sidelines forever – LPs won’t let them. As the industry begins to whittle down record amounts of capital, dealflow and exit values could return to some degree of normalcy, particularly now that the Federal Reserve appears to have taken its foot off the rate gas pedal, even if broader market uncertainty continues to linger for the near term.

1. Sabater, A., & Thomas, D. (2023a, July 20). Private equity dry powder swells to record high amid sluggish dealmaking. S&P Global. https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/private-equity-dry-powder-swells-to-record-high-amid-sluggish-dealmaking-76609335

2. Barragán, B. (2023a, October 11). Investors waiting to deploy billions in dry powder, eying value-add, opportunistic strategies. Bisnow. https://www.bisnow.com/national/news/capital-markets/investors-still-waiting-to-deploy-billions-in-dry-powder-121055

3. Sabater, A., & Thomas, D. (2023, July 20). Private equity dry powder swells to record high amid sluggish dealmaking. S&P Global. https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/private-equity-dry-powder-swells-to-record-high-amid-sluggish-dealmaking-76609335

4. Shi, M. (2023, July 28). Growth equity deal flow defies slowdown in PE dealmaking – pitchbook. Pitchbook. https://pitchbook.com/news/articles/growth-equity-investment-dilution-pe-buyouts

5. Steenis, H. van. (2023, November 28). Private credit boom will trigger a new squeeze. Financial Times. https://www.ft.com/content/b8e151c7-7302-4464-bc49-5091df86ec40

6. Brush, S. (2023, October 26). Blackrock (BLK) predicts private debt market to double to $3.5 trillion by 2028. Bloomberg.com. https://www.bloomberg.com/news/articles/2023-10-26/blackrock-says-private-debt-will-double-to-3-5-trillion-by-2028

7. Barragán, B. (2023, October 11). Investors waiting to deploy billions in dry powder, eying value-add, opportunistic strategies. Bisnow. https://www.bisnow.com/national/news/capital-markets/investors-still-waiting-to-deploy-billions-in-dry-powder-121055

8. Wallace, CFA, FDP, R. (2023, October 10). Exploring the UK pension and insurance market using S&P CapIQ Pro. SP Global. https://www.spglobal.com/marketintelligence/en/news-insights/blog/exploring-the-uk-pension-and-insurance-market-using-sp-capiq-pro

The information contained herein is for informational and educational purposes only and is not an offer to sell or a solicitation of any offer to buy any securities. The information contained herein is not intended to and does not constitute investment, legal, or tax advice, or recommendation of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Any investment in securities involves a high degree of risk and may not be suitable for all investors and you should consult with an expert before making investment decisions. The views or opinions expressed herein represent those of Ignite Investments, LLC (“Ignite”) or its affiliated sponsors at the time of publication. No assurance can be provided that any of the future events referenced herein (including but not limited to projected or estimated returns or performance results) will occur on the terms contemplated herein or at all. While the data contained herein has been prepared from information that Ignite believes to be reliable, Ignite does not warrant the accuracy or completeness of such information. Please see Terms & Conditions for full disclosures.

© 2023 IGNITE INVESTMENTS, LLC