PORTFOLIO DIVERSIFICATION

WITH PRIVATE INVESTMENT IN

COMMERCIAL REAL ESTATE

May 2021

Today more than ever, investors are looking to strike the right balance between the preservation of capital, generating alpha, and offsetting market volatility.1 One of the asset classes that overwhelmingly meets these criteria is commercial real estate, and investors are increasingly taking notice.

What is Alpha?

Alpha represents the return on investment (ROI) that surpasses that of a given benchmark, such as the S&P 500 index or another index fund.

The amount of private capital invested globally is predicted to nearly double to $18.3 trillion by year-end 2027 compared with 2021 levels, fueled by retail interest in alternative assets, according to Preqin.2 Additionally, Preqin predicts real estate assets under management (AUM) will reach $2.14 trillion by year-end 2027 alongside a median net IRR of 15% for real estate funds with a 2019 vintage.

Traditionally, investors sought the efficient frontier through a portfolio of stocks and bonds based on their risk profile, perhaps following the Warren Buffett 90/10 rule of allocating to a low-cost S&P 500 index fund and short-term government bonds, respectively.3 However, given the current macroeconomic backdrop, investors are now seeking to offset risk through portfolio diversification and exposure to assets whose performance is non-correlated to stocks and bonds.4

COMMERCIAL REAL ESTATE BENEFITS

Institutional investors and financial advisors have long agreed that alternative investments including real estate assets introduce a host of benefits to a portfolio, helping investors to potentially bolster returns, manage risk, and achieve greater diversification.5 Other advantages include:6

- Potentially outsized returns at reduced volatility with low correlation to market instability

- The opportunity to generate stable income while preserving capital, building equity through capital appreciation

- Portfolio diversification through direct investment

- Rising commercial property values appreciating with inflation, allowing investors to retain real value throughout various market cycles

Importantly, it’s not just institutional investors allocating to alternative assets. Innovation on the financial product side has paved the way for savvy investors seeking higher yields, lower volatility, and noncorrelated returns to gain exposure to alternative assets, including commercial real estate.

Through such products, investors can generally gain access to features such as improved liquidity, lower investment minimums, and straightforward tax-reporting procedures, making exposure to alternative investments that much simpler.

ALTERNATIVE INVESTING USING THE YALE MODEL

Investors looking to achieve steady long-term income have been known to follow the Yale endowment investment model as the university’s long-term results remain in the top tier of institutional investors. Yale, which oversees the country’s second-biggest university endowment, relies less on traditional asset classes, such as stocks and bonds, and more heavily on exposure to alternative assets, including private equity, venture capital, hedge funds, and real estate.

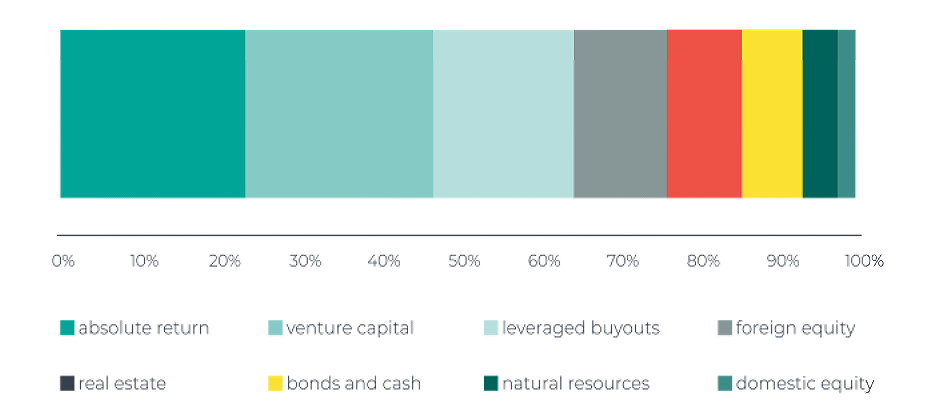

Yale Endowment Allocation Targets for 2021

(Click image to view larger)

Source: Yale News September 2020

As of 2020, Yale’s asset allocation was spread across venture capital, absolute return, leveraged buyouts, cash and fixed income, foreign equity, natural resources, and domestic equity. The university’s endowment generated returns of over 40% in 2021, its best performance in two decades.7,8

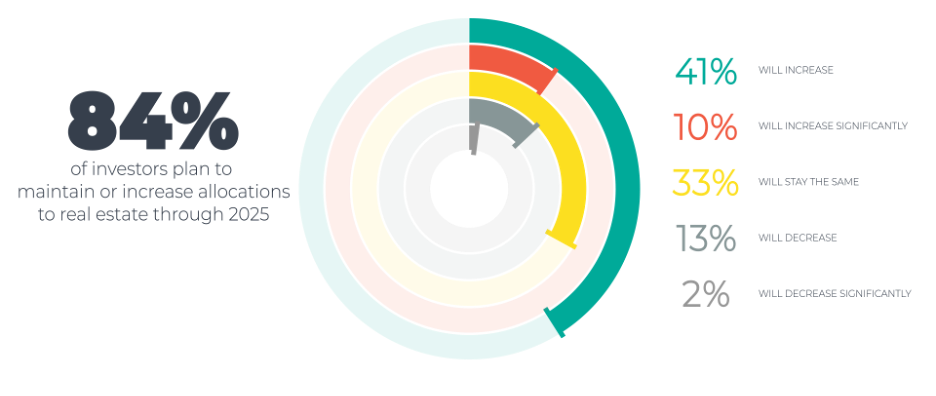

Anticipated Real Estate Allocations 2021-2025

(Click image to view larger)

Source: Preqin Investor Survey August 2020

In line with the Yale model, 33% of investors report that they are planning to maintain their real estate exposure, with another 51% aiming to increase real estate allocations through 2025, an indication that most investors remain confident in the commercial real estate sector despite recent market uncertainty.

COMMERCIAL REAL ESTATE RETURNS

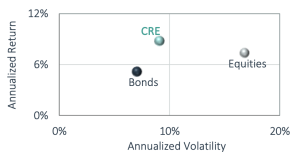

Historically, commercial real estate has experienced equity-like returns with bond-like volatility. Over the last 20 years, bonds have earned lower returns for conservative investors, while more aggressive investors have achieved higher returns through risky stocks.

20-Year Annualized Risk/Return Profile

(Click image to view larger)

Source: NCREIF, Bloomberg, and CoStar Advisory Services as of Q1 2021. Commercial Real Estate as represented by NCREIF Property Index; Bonds are represented by Barclays Aggregate Bond Index; Equities as represented by S&P 500.

Commercial real estate, however, has fallen in the most desirable northwest quadrant of the risk-return matrix, generating favorable risk-adjusted returns for investors. Long-term investors recognize that commercial real estate provides greater return potential with lower risk than traditional asset classes, with far reaching benefits.

1. Bankrate. (2022, September 6). Alpha in investing: What it is and how it works. https://www.bankrate.com/investing/what-is-alpha/

2. Preqin. (2022, October 5). Global private capital AUM to double to $18.3TN by 2027 – Preqin forecasts. https://www.preqin.com/portals/0/documents/foa%20press%20release%20final.pdf

3. Buffett, W. E. (2013). Berkshire’s corporate performance vs. the S&P 500 – Berkshire Hathaway. Berkshire Hathaway. https://www.berkshirehathaway.com/letters/2013ltr.pdf

4. Gross, W. H. (2023, October 4). Neither a lender nor a stockholder be. Bill Gross. https://williamhgross.com/neither-a-lender/

5. Nielson, D., Iantchev, E., Chen, H., Bowden, D., & Faille, S. (2023). A study of allocations to alternative investments by institutions and financial advisors. Fidelity Institutional. https://institutional.fidelity.com/app/proxy/content?literatureURL=/9909500.PDF

6. Maccarrone, D. (2022, November 1). Alternatives 2.0: Innovative ways to diversify your portfolio. Morgan Stanley. https://www.morganstanley.com/ideas/alternative-investments-portfolio-diversification

7. Shao, Z. (2021, October 14). Yale’s endowment reaches $42.3 billion, posting highest rate of return since 2000. Yale Daily News. https://yaledailynews.com/blog/2021/10/14/yales-endowment-reaches-42-3-billion-posting-highest-rate-of-return-since-2000/

8. Gorelick, E. (2022, October 24). Yale’s endowment, explained. Yale Daily News. https://yaledailynews.com/blog/2022/10/24/yales-endowment-explained/

The information contained herein is for informational and educational purposes only and is not an offer to sell or a solicitation of any offer to buy any securities. The information contained herein is not intended to and does not constitute investment, legal, or tax advice, or recommendation of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Any investment in securities involves a high degree of risk and may not be suitable for all investors and you should consult with an expert before making investment decisions. The views or opinions expressed herein represent those of Ignite Investments, LLC ("Ignite") or its affiliated sponsors at the time of publication. No assurance can be provided that any of the future events referenced herein (including but not limited to projected or estimated returns or performance results) will occur on the terms contemplated herein or at all. While the data contained herein has been prepared from information that Ignite believes to be reliable, Ignite does not warrant the accuracy or completeness of such information. Please see Terms & Conditions for full disclosures.

Investments in commercial real estate (CRE) involve significant risks, including market risks, interest rate risks, and liquidity risks, and may not be suitable for all investors.

Securities transactions conducted through Umergence, LLC. Member: FINRA/SIPC. Umergence is not affiliated with any entities identified in this communication.

© 2023 IGNITE INVESTMENTS, LLC