POP CULTURE MEETS COMMERCIAL REAL ESTATE

April 2024

The intersection of pop culture and commercial real estate is a dynamic and increasingly influential space, where the whims of billionaires, trending TV shows, landmark Supreme Court decisions, and the persuasive power of social media converge to reshape market dynamics in unexpected ways. The influence of pop culture extends far beyond mere entertainment, playing a pivotal role in determining the value, demand, and development of commercial properties across the nation.

Let’s take a moment to break down the impact of some of society’s most prevalent trends, beginning with the much reported on Taylor Swift economy.

SWIFT LIFTS HOSPITALITY

If there was ever any doubt about the influence pop culture has on investing, Taylor Swift has laid those to rest. In 2023 alone, the Taylor Swift economy, as it’s known, contributed billions to both local markets and the broader U.S. economy. Dubbed “The Swift Lift” by the Mastercard Economics Institute, this effect led to a 68% average daily increase in restaurant spending within a 2.5-mile radius of the stadiums hosting her concerts. Furthermore, according to STR data, The Eras tour boosted U.S. hotel revenue by $208 million from June to early August, with the first 28 shows contributing nearly $100 million. Specifically, Seattle’s RevPAR hit a new all-time high of $317 in July, surging 38% over its previous record set during an MLB All-Star Game in the same month.

SCOTUS DECIDES

The nation eagerly anticipated the Supreme Court’s ruling last June on student loan forgiveness, which ultimately struck down the possibility of debt relief. This decision has the potential to profoundly impact on the economy and, consequently, the commercial real estate sector. With the ruling against dismantling debt obligations, there’s been less incentive for new household formation among those who had hoped for relief; this has implications for the multifamily sector as it retains borrowers within the rental market, and may dampen discretionary spending, potentially affecting brick-and-mortar retail and reshaping leisure travel with a preference for mid-scale and economy lodging. In response to the ruling the current administration, has enacted a new student debt relief initiative, “Saving on a Valuable Education (SAVE) Plan,” which has been met with controversy.

MONTANA’S REAL ESTATE STAMPEDE

Montana’s economy is thriving, and its real estate market is booming, largely thanks to the popularity of the TV show “Yellowstone,” starring Kevin Costner. The show has captivated America, drawing approximately 2.1 million tourists in 2021, who contributed $730 million to the state’s economy and are significantly responsible for propelling Montana to have the seventh-fastest growing state economy in the U.S. These fans are not just passing through; many are choosing Montana as either their primary or secondary residence. This surge in interest, especially in Bozeman, has propelled condo and single-family home prices to nearly $750,000 since 2020, significantly driving up the cost of living and spurring rapid development, which ironically or not, is a hot-button issue in the show.

TIKTOK TRAVEL

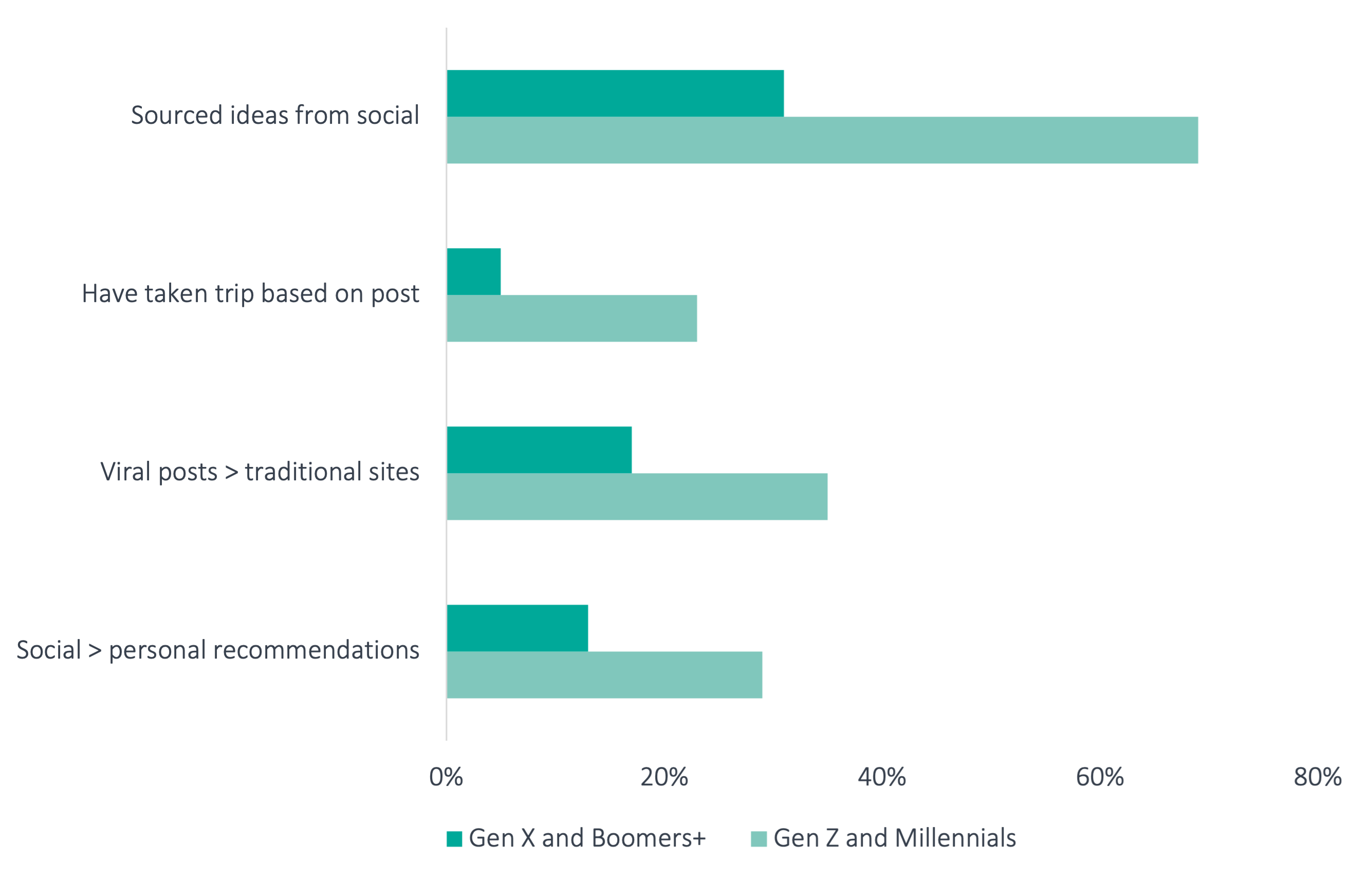

Americans are increasingly putting travel at the top of their bucket lists for 2024. Their source of inspiration? Largely, Instagram and TikTok. According to a survey by TripIt, a travel planning site, pop-culture-inspired travel is poised to roughly double this year, from 22% to 40% compared with 2023 levels, a trend fueled by Millennials and Gen Zers. Their reasons for traveling vary, ranging from attending concerts located in different cities to sightseeing to visiting the filming locations of feature films or television series. There’s also a direct link between income levels and tourism, with travelers earning below $50,000 annually showing a higher propensity for pop-culture-related trips vs. higher earners. More than half (54%) of participants across generations in the TripIt survey are motivated to travel by social media.

Who Relies on Social Media for Trip Ideas

Gen Z and Millennials Twice as Likely to Source Trip Inspo on Social

(Click image to view larger)

Source: Image by TripIt

A BILLIONAIRE’S OWN TOWN

Since moving his Tesla Gigafactory from Silicon Valley to Austin, Texas in 2021, tech billionaire Elon Musk intends to expand his footprint in the Lone Star State with his envisioned company town “Snailbrook.” This relocation aligns with a broader trend; between 2018 and 2023, Austin saw the most corporate relocations of any other American city, counting 66 moves, half of which were tech companies and most citing lower taxes as their primary driver. In response to job growth, homeowners appear to have followed. Between 2020 and 2023, the median sale price across home types in Austin soared by almost $100,000, buttressed by an in-migration trend to the area from states like California, Illinois, Washington, and New York, according to Redfin data. While Snailbrook will reportedly span up to 6,000 acres just outside Austin, whether it will disrupt the city’s robust market dynamics remains to be seen.

POST-SEASON BOON

Post-season games provide a major boon to local economies across the NFL, MLB, and NBA. According to Business Insider, host cities for the NFL’s Super Bowl experience an economic impact of over $1.0 billion. Las Vegas, which hosted the 2024 Super Bowl game between the Kansas City Chiefs and the San Francisco 49ers, was projected to experience a gross economic impact of $1.1 billion during game weekend. Las Vegas hotels were a major beneficiary, as 330,000 visitors embarked on Sin City in early 2024. The average nightly hotel rates across the city were estimated to have reached $573 between Feb. 9 and Feb. 11, surpassing any other Super Bowl weekend historically and compared with $215 for the big game weekend in the prior year.

ONWARD

As we look ahead, the spotlight is squarely on artificial intelligence (AI), and its potential to revolutionize both our digital and physical world. How that will manifest, particularly for commercial real estate, remains a topic of intense speculation. While we wait for that to unfold, we can address a simpler question: Should pop cultural trends influence our commercial real estate investment strategies?

Certainly, the bedrock of investment due diligence—factors such as market dynamics and sector-specific trends—remains paramount. However, there is merit in broadening our analytical lens to include the cultural phenomena that capture our collective imagination. Such considerations may serve to indicate emerging opportunities or, more prudently, highlight shifting dynamics best to be avoided.

The information contained herein is for informational and educational purposes only and is not an offer to sell or a solicitation of any offer to buy any securities. The information contained herein is not intended to and does not constitute investment, legal, or tax advice, or recommendation of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Any investment in securities involves a high degree of risk and may not be suitable for all investors and you should consult with an expert before making investment decisions. The views or opinions expressed herein represent those of Ignite Investments, LLC (“Ignite”) or its affiliated sponsors at the time of publication. No assurance can be provided that any of the future events referenced herein (including but not limited to projected or estimated returns or performance results) will occur on the terms contemplated herein or at all. While the data contained herein has been prepared from information that Ignite believes to be reliable, Ignite does not warrant the accuracy or completeness of such information. Please see Terms & Conditions for full disclosures.

Investments in commercial real estate (CRE) involve significant risks, including market risks, interest rate risks, and liquidity risks, and may not be suitable for all investors.

Securities transactions conducted through Umergence, LLC. Member: FINRA/SIPC. Umergence is not affiliated with any entities identified in this communication.

© 2024 IGNITE INVESTMENTS, LLC