Looking Beyond Returns:

Identifying the Balance between Risk

& Return in Real Estate

July 2023

When it comes to investing in commercial real estate, the financial rewards that come with a successful investment can be very appealing. However, current market conditions may prove that the real estate investment returns that investors have become accustomed to over the last 10 years, may now come with heightened risk. This is why it is equally important, when considering a new investment, to carefully assess potential risk alongside potential returns.

EVALUATING RISK TOLERANCE

Each real estate investment carries its own set of rewards and risks which should be weighed against the individual needs of the investor; investors may consider the overall composition of their investment portfolio, their desire for capital preservation and/or capital appreciation, their current real estate allocations, their liquidity needs and what amount of exposure to market dynamics is acceptable for their respective portfolios.

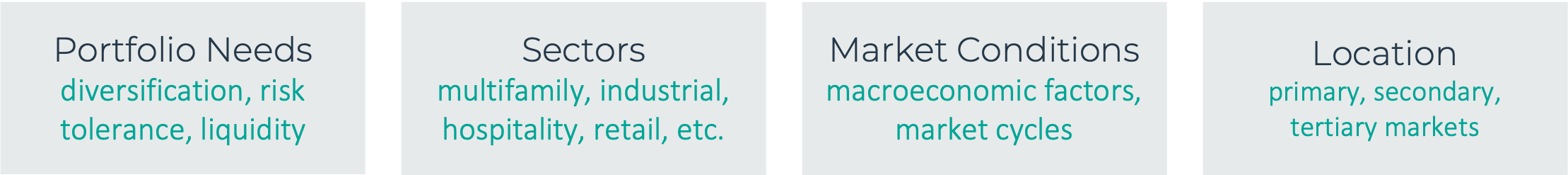

Any investor may consider evaluating these criteria when selecting a commercial real estate investment that aligns with one’s individual risk tolerance and portfolio diversification goals:

(Click image to view larger)

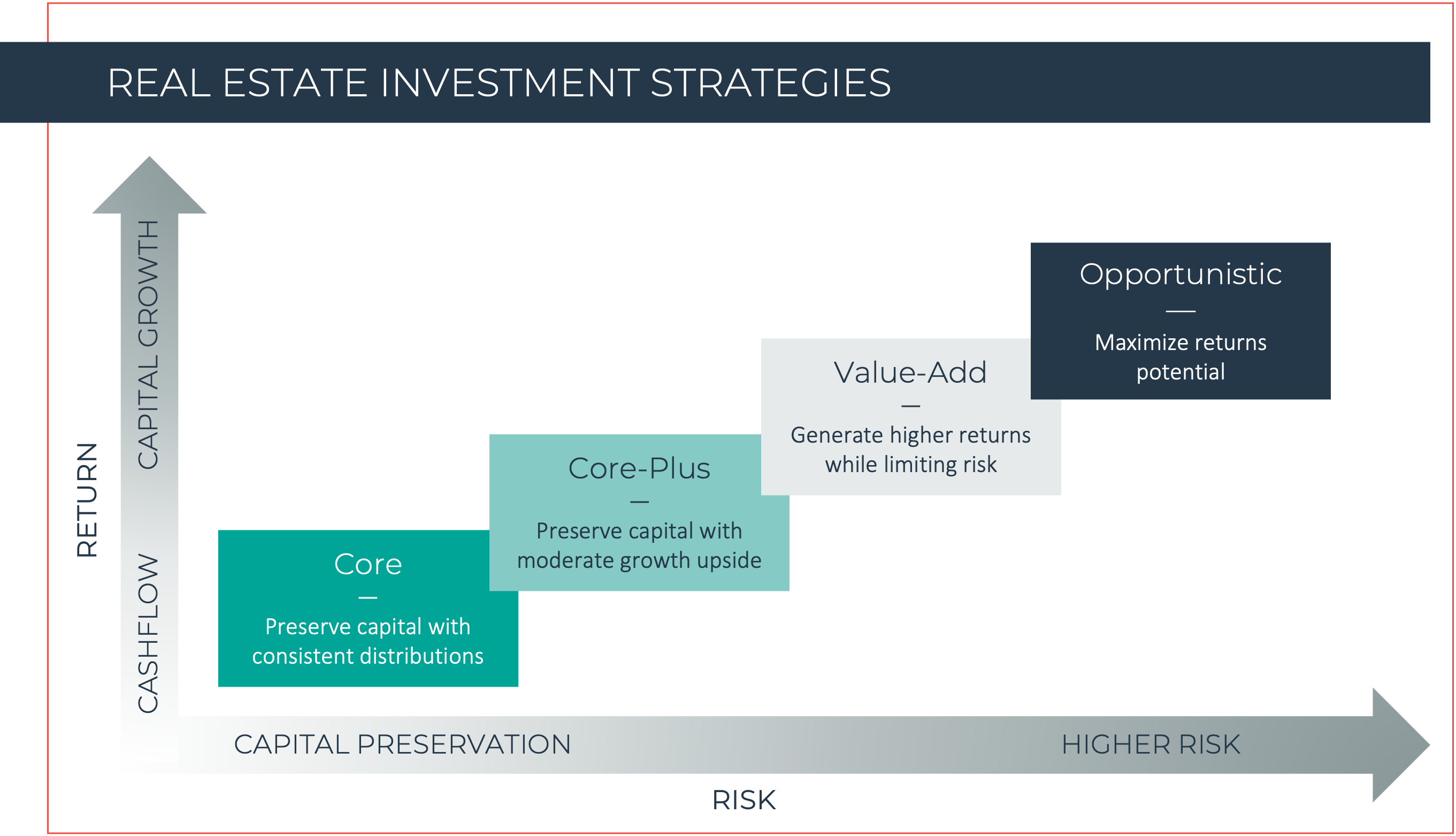

The four primary real estate investment strategies are core, core plus, value-add, and opportunistic and each strategy falls along a risk/return matrix, as shown below. Asset location, financing, and capital structure as well as the performance history of the sponsor also influence the risk profile of any real estate investment.

(Click image to view larger)

An investment’s quality, financial and physical condition, and location are also factors in determining its risk. The following are the typical attributes for each of the four primary real estate investment strategies:

![]() Core real estate investments are considered the lowest risk real estate strategy. The strategy may focus on acquiring high-quality, income-generating properties in established and prime locations. These investments typically offer steady cash flows, minimal vacancy risks, and long-term leases with creditworthy tenants.

Core real estate investments are considered the lowest risk real estate strategy. The strategy may focus on acquiring high-quality, income-generating properties in established and prime locations. These investments typically offer steady cash flows, minimal vacancy risks, and long-term leases with creditworthy tenants.

Example: Newly Stabilized Class A Multifamily Acquisition

Investment Goal: Preserve capital with consistent distributions

Typical Attributes:

– Stable income

– Under 30% debt leverage

– Lower growth opportunity

– Often primary markets

– Lowest risk profile

![]()

Core plus investments involve acquiring properties typically offer stable income and may also have the opportunity for value enhancement through targeted improvements, repositioning, or proactive management strategies. These investments generally have a low to moderate level of risk and aim to generate both income and capital appreciation.

Example: Grocery-Anchored Retail Acquisition

Investment Goal: Preserve capital with moderate growth upside

Typical Attributes:

– Steady cashflow

– 30-55% debt leverage

– Stable long-term leases

– Moderate growth opportunity

– Lower correlation to market dynamics

![]() Value-add real estate investments involve acquiring properties that require significant improvements, through renovations or repositioning strategies, aimed to enhance the property value and increase income potential. Value-add investments typically carry a higher level of risk compared to core and core plus investments but offer the potential for higher returns; existing occupancy makes these investments lower risk than new developments.

Value-add real estate investments involve acquiring properties that require significant improvements, through renovations or repositioning strategies, aimed to enhance the property value and increase income potential. Value-add investments typically carry a higher level of risk compared to core and core plus investments but offer the potential for higher returns; existing occupancy makes these investments lower risk than new developments.

Example: Vintage Hospitality Acquisition

Investment Goal: Generate higher returns while limiting risk

Typical Attributes:

– Established or variable cashflow with room for growth

– 50-70% debt leverage

– Requires capital for property improvements

– Medium exposure to market dynamics

![]() Opportunistic real estate investments may target assets or situations with significant potential for value creation, including ground-up developments or acquisitions requiring extensive repositioning. These higher-risk investments require experienced managers to achieve their desirable return profiles.

Opportunistic real estate investments may target assets or situations with significant potential for value creation, including ground-up developments or acquisitions requiring extensive repositioning. These higher-risk investments require experienced managers to achieve their desirable return profiles.

Example: Class A Multifamily Development

Investment Goal: Maximize Return Potential

Typical Attributes:

– 60%+ debt leverage

– Heavy capital investment

– Requires experienced sponsor

– Higher exposure to price fluctuations and evolving markets

ACHIEVING A BALANCED REAL ESTATE PORTFOLIO

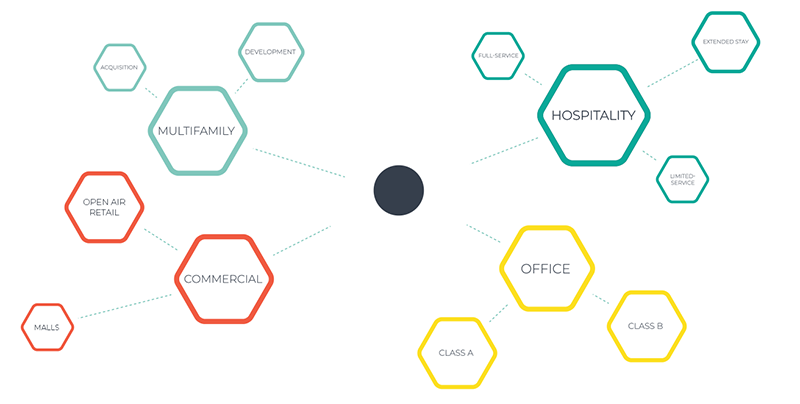

A well-diversified real estate portfolio includes complementary asset types spread across different sectors and geographic regions, each serving a key function to balance risk while aiming to deliver returns.

(Click image to view larger)

For example, by combining the income-generating ability of core and core plus assets (such as grocery-anchored retail) with the higher potential for capital appreciation of value-add and opportunistic investments (such as multifamily development), investors can benefit from a portfolio that seeks to achieve multiple investment goals while also balancing risk across the portfolio.

Here are three reasons why risk diversification in commercial real estate may stabilize portfolio returns over time:

- Minimize Exposure: A well-diversified portfolio helps mitigate the impact of individual property or geographic risks and can typically better withstand economic downturns, regulatory changes, or other industry-specific challenges.

- Income Stability: Exposure to assets across real estate sectors, such as retail, office, industrial, hospitality, or residential, may generate income at different times or in different economic environments, which can diversify sources of cash flow.

- Capital Appreciation Potential: Diversifying across sectors, geographic locations and property types increases the likelihood of capturing opportunities for capital appreciation across sectors and market cycles.

Access Real Estate Through Ignite

Ignite recognizes the complexities required to properly due diligence each commercial real estate investment and determine its risk profile. Thus, Ignite exclusively partners with sponsors that follow rigorous investment criteria and use proprietary research to evaluate sector, market, and property strength, focused on post-GFC recession and post-pandemic demand drivers, including population and employment growth, migration trends, new household formation, education attainment, rent growth, tenant profiles and lease terms, financial projections, and geopolitical and macroeconomic considerations. While the return potential of a commercial real estate investment is undoubtedly a critical consideration, expected return is only one part of the equation.

Ask yourself, what risk am I taking to get this return?

Ignite prioritizes its investor partnerships and aims to empower its investors through education and exclusive access to sponsors with strong track records across market cycles.

The information contained herein is for informational and educational purposes only and is not an offer to sell or a solicitation of any offer to buy any securities. The information contained herein is not intended to and does not constitute investment, legal, or tax advice, or recommendation of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Any investment in securities involves a high degree of risk and may not be suitable for all investors and you should consult with an expert before making investment decisions. The views or opinions expressed herein represent those of Ignite Investments, LLC (“Ignite”) or its affiliated sponsors at the time of publication. No assurance can be provided that any of the future events referenced herein (including but not limited to projected or estimated returns or performance results) will occur on the terms contemplated herein or at all. While the data contained herein has been prepared from information that Ignite believes to be reliable, Ignite does not warrant the accuracy or completeness of such information. Please see Terms & Conditions for full disclosures.

Investments in commercial real estate (CRE) involve significant risks, including market risks, interest rate risks, and liquidity risks, and may not be suitable for all investors.

Securities transactions conducted through Umergence, LLC. Member: FINRA/SIPC. Umergence is not affiliated with any entities identified in this communication.

© 2023 IGNITE INVESTMENTS, LLC