INVESTING IN COMMERCIAL

REAL ESTATE THROUGH

A SELF-DIRECTED IRA

October 2023

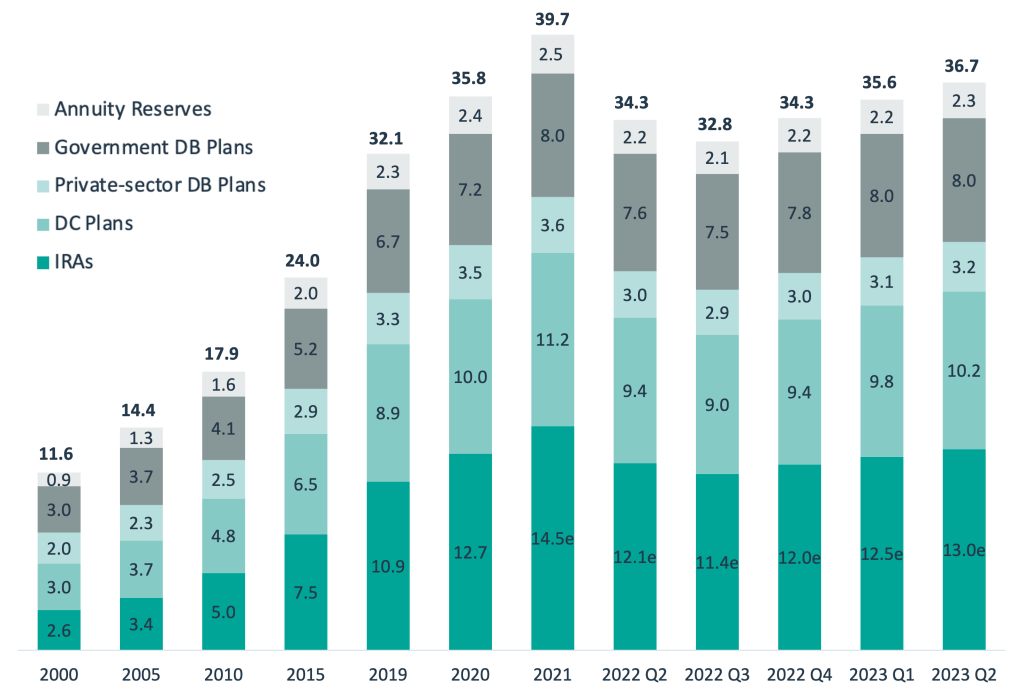

Investing through Individual Retirement Accounts (IRAs) is on the rise as investors seek greater control of their retirement savings. According to the Investment Company Institute (ICI), as of Q2 2023, total U.S. retirement assets hovered at $36.7 trillion, representing nearly one-third of all household financial assets nationwide. Of that amount, $13 trillion in assets were invested through IRAs, up nearly 4% compared with Q1 2023, as per Investment Company Institute “ICI” data.

U.S. Total Retirement Market Assets

(trillions of dollars, end-of period, selected periods)

(Click image to view larger)

“e” means estimated. Sources: Investment Company Institute, Federal Reserve Board, Department of Labor, National Association of Government Defined Contribution Administrators, American Council of Life Insurers, and Internal Revenue Service Statistics of Income Division

However, while more investors are recognizing the benefits of investing through an IRA, many are not aware that IRAs can be used to fund investments into alternative assets such as commercial real estate. As of Q2 2023, 42% of IRA assets, or $5.5 trillion, were directed into equity and bond mutual funds, ICI data reveal, the balance of which were invested in individual stocks and bonds, real estate investment trusts (REITs), exchange-traded funds (ETFs), and alternative assets.

Instead of only offering stocks, bonds, and mutual funds as investment options, a self-directed IRA custodian allows individuals to invest in a variety of alternative assets, including commercial real estate, through both traditional and ROTH IRAs.

MONEY ON THE MOVE

The accessibility and technological advancements of self-directed IRA custodians have reduced many of the complexities and hurdles associated with CRE investing through an IRA account. Custodian account on-boarding and investment review can often be accomplished in as little as 24-48 hours through an online portal and working with Ignite’s designated account specialists.

Whether investors are looking to open a new self-directed IRA, move funds from an existing IRA, or roll over money from an employer sponsored plan such as a 401(K)-retirement plan, each option offers the opportunity to diversify their investment portfolio through exposure to alternative asset classes.

IRAs and commercial real estate pack a powerful punch that can be harnessed to diversify a retirement portfolio aimed to grow one’s savings in a tax-advantaged way.

REAL ESTATE IRA INVESTMENTS: THE OPPORTUNITY

- Tax Benefits: Investors can achieve potential tax savings. IRAs provide an opportunity for tax-free or tax-deferred investment growth of retirement savings. The type of IRA, traditional or ROTH, and asset in which one invests impacts the potential tax, or lack thereof, for a given account.

- Portfolio Diversification: Access to alternative asset classes such as commercial real estate enhance portfolio diversification beyond traditional investments like stocks and bonds, potentially reducing portfolio volatility over time.

- Non-Correlated Returns: Alternative investments provide an opportunity for income and returns that are non-correlated to stocks, bonds, and publicly traded real estate, thereby providing an additional potential diversification benefit. Historically, private commercial real estate has shown low correlation to the public markets.

Simplified Access Through Ignite Investments and Midland Trust

Midland Trust specializes in IRAs, including the facilitation of investments into Ignite Investments’ offerings. Just follow these three steps to gain greater exposure to Ignite Investments products through an IRA with Midland Trust:

- Custom webpage for Ignite Investors: Open an Account

- Fund the account

- Review, sign, and authorize the new investment via a DocuSign document

Any income, distributions, or sale proceeds from your investments with Ignite will be directed back to your IRA account.

If you are interested in diversifying your retirement portfolio with commercial real estate, contact us and we will get you started.

Access additional resources here:

The information contained herein is for informational and educational purposes only and is not an offer to sell or a solicitation of any offer to buy any securities. The information contained herein is not intended to and does not constitute investment, legal, or tax advice, or recommendation of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Any investment in securities involves a high degree of risk and may not be suitable for all investors and you should consult with an expert before making investment decisions. The views or opinions expressed herein represent those of Ignite Investments, LLC (“Ignite”) or its affiliated sponsors at the time of publication. No assurance can be provided that any of the future events referenced herein (including but not limited to projected or estimated returns or performance results) will occur on the terms contemplated herein or at all. While the data contained herein has been prepared from information that Ignite believes to be reliable, Ignite does not warrant the accuracy or completeness of such information. Please see Terms & Conditions for full disclosures.

© 2023 IGNITE INVESTMENTS, LLC