FED TAKES BREATHER

ON INTEREST RATES:

Faces Steep Terrain Up Ahead

September 2023

Following the launch of a hawkish monetary policy campaign in March 2022, the central bank has finally taken its foot off the interest rate gas pedal – for now. Fed Chairman Jerome Powell and company at the September FOMC meeting decided to leave rates unchanged, maintaining a target range of 5.25% to 5.5% and resulting in a collective sigh of relief among dealmakers and investors alike.1

COMMERCIAL REAL ESTATE IMPACT:

Higher Fed interest rates increase the cost of capital for commercial real estate borrowers and investors.

However, Powell also made it clear that they are prepared to raise by another quarter-point again “if appropriate” amid sticky inflation that continues to surpass the central bank’s elusive 2% long-run target.2 In addition to inflation, policymakers are also weighing a combination of economic tailwinds, including stronger than expected GDP coupled with a robust labor market, and headwinds, comprising tight credit conditions for both families and businesses, including commercial real estate.3

On the other hand, the Fed’s gambit includes potential interest rate cuts in 2024, albeit likely at a slower pace than many had previously hoped. While Powell holds those cards close to the vest, he admits “the time will come at some point…that it’s appropriate to cut,” refusing to say exactly when.

All in all, the Fed is traversing some steep terrain, guided by incoming economic data that will determine the direction of interest rates at the two remaining FOMC meetings of 2023.

SOFT LANDING

Early in 2023, it appeared that there was no escaping inflation without a recession or spike in the unemployment rate. However, with the fourth quarter just a stone’s throw away, it now seems clear that the U.S. economy may have averted both. The labor market remains solid while the economy keeps humming along.4

(Click image to view larger)

Meanwhile, the Fed continues to target what Powell describes as a “soft landing” for the economy – a slowdown without whiplash — something that he believes is still plausible but not promised.

“A soft landing is a primary objective,” he stated. “That’s what we’ve been trying to achieve, for all this time.” Meanwhile, the Fed is prepared to “proceed carefully” on rates until there is more progress on the inflationary front.

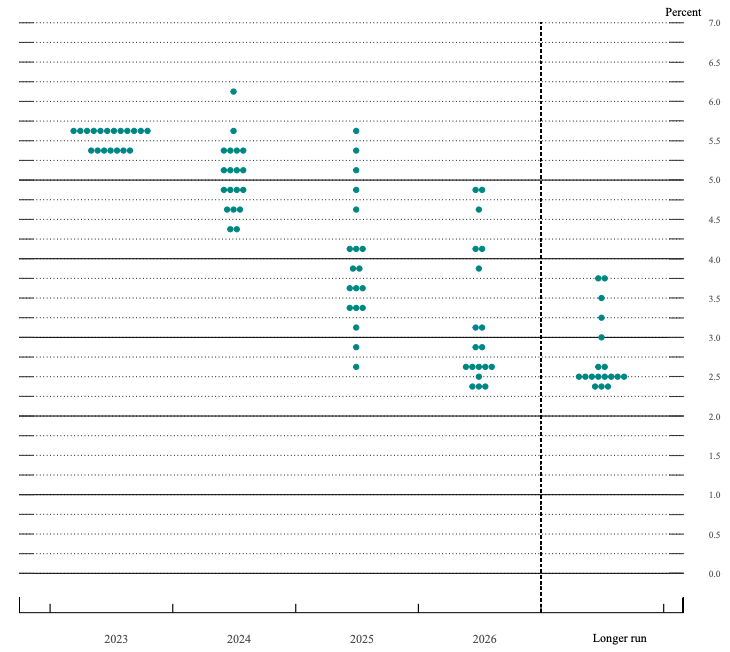

DOT PLOT

Fed officials continue to target 2% inflation, despite calls from economists like Mohamed El-Erian, Chief Economic Advisor at Allianz, to consider a higher goal of 3% to keep a recession from rearing its head. Nevertheless, central bankers have mixed ideas about what it will take to achieve price stability.5

According to the Fed’s famous “dot plot,” reflecting where individual policymakers lean on rates, 12 out of 19 Federal Open Market Committee (FOMC) members build in one more rate increase in 2023. The other seven members believe it is appropriate to stay the course on current monetary policy to tame inflation. On the flip side, interest rate cuts appear to be on the horizon as soon as 2024.

Either way, it does seem that elevated rates, comparatively speaking, are the new normal for the foreseeable future amid a growing economy.6 Prior to 2023, the Fed’s target range hadn’t breached the 5% level since 2007.7 Looking ahead, the median “dot plot” interest rate projection hovers just above 5% for 2024 before falling to below 4% in 2025 and continuing that downward trajectory.8

Federal Open Market Committee Dot Plot

September 20, 2023

(Click image to view larger)

Source: Federal Open Market Committee (FOMC)

Note: FOMC participants’ assessments of appropriate monetary policy:

Midpoint of target range or target level for the federal funds rate

TAKEAWAY

Yet another rate hike by the Fed in 2023 would mark the 12th such increase since embarking on its hawkish monetary policy campaign last year. Nevertheless, even with two more FOMC meetings on the docket for 2023, the worst of the rate-tightening cycle appears to be behind us as prices finally show early signs of stability and economists shift their attention to the start of a forthcoming rate-cutting cycle.9

1. J.P. Morgan Chase. (2022, August 3). Rising interest rates’ effect on multifamily properties. Rising Interest Rates’ Effect on Multifamily Properties. https://www.jpmorgan.com/insights/real-estate/commercial-real-estate/rising-interest-rates-effect-on-commercial-real-estate

2. Transcript of chair Powell’s press conference September 20, 2023. (2023, September 20). https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20230920.pdf

3. Probasco, J. (2023, September 13). Inflation and the housing market. Bankrate. https://www.bankrate.com/real-estate/inflation-housing-market/

4. Pickert, R., & Tanzi, A. (2023, July 21). Unemployment rate at or near record lows in half of US states. Bloomberg.com. https://www.bloomberg.com/news/articles/2023-07-21/jobless-rates-in-half-of-us-states-are-at-or-near-record-low#xj4y7vzkg

5. Ryssdal, K., & Leeson, S. (2023, August 3). Mohamed El-Erian on Fed’s inflation target: “there’s nothing scientific about 2%.” Marketplace. https://www.marketplace.org/2023/08/03/mohamed-el-erian-on-feds-inflation-target-theres-nothing-scientific-about-2/

6. Foster, S. (2023, September 20). Fed’s interest rate history: The Fed funds rate since 1981. Bankrate. https://www.bankrate.com/banking/federal-reserve/history-of-federal-funds-rate/

7. Cox, J. (2023, May 4). Fed increases rates a quarter point and signals a potential end to hikes. CNBC. https://www.cnbc.com/2023/05/03/fed-rate-decision-may-2023-.html

8. Torres, C., Marte, J., & Curtis, L. (2023, September 22). More interest rate hikes possible while inflation continues, fed officials says. Bloomberg.com. https://www.bloomberg.com/news/articles/2023-09-22/fed-officials-see-more-rate-hikes-possible-as-inflation-persists?srnd=premium#xj4y7vzkg

9. Romei, V., Giles, C., Arnold, M., & Smith, C. (2023, September 24). A “milestone” moment: Why economists think the global cycle of rate rises is over. Financial Times. https://www.ft.com/content/18ccb74f-52c1-4d94-a7f1-5541b134d5c0

The information contained herein is for informational and educational purposes only and is not an offer to sell or a solicitation of any offer to buy any securities. The information contained herein is not intended to and does not constitute investment, legal, or tax advice, or recommendation of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Any investment in securities involves a high degree of risk and may not be suitable for all investors and you should consult with an expert before making investment decisions. The views or opinions expressed herein represent those of Ignite Investments, LLC (“Ignite”) or its affiliated sponsors at the time of publication. No assurance can be provided that any of the future events referenced herein (including but not limited to projected or estimated returns or performance results) will occur on the terms contemplated herein or at all. While the data contained herein has been prepared from information that Ignite believes to be reliable, Ignite does not warrant the accuracy or completeness of such information. Please see Terms & Conditions for full disclosures.

Investments in commercial real estate (CRE) involve significant risks, including market risks, interest rate risks, and liquidity risks, and may not be suitable for all investors.

Securities transactions conducted through Umergence, LLC. Member: FINRA/SIPC. Umergence is not affiliated with any entities identified in this communication.

© 2023 IGNITE INVESTMENTS, LLC