BEHIND THE

BRICK & MORTAR:

A Conversation with Encore

Construction’s Dwayne Rash

November 2023

Challenges are nothing new to commercial real estate development. However, the past couple of years have required greater fortitude and resilience than usual in the face of fluctuating construction costs, a sluggish supply chain, and labor market constraints, effectively sifting the wheat from the chaff and giving only seasoned developers with experience in changing market cycles and established long-standing relationships the upper hand.

The result has been a thinning out of competition; commercial and multifamily construction starts plummeted 14% nationally in H1 2023 year-over-year, altering the demand dynamics in favor of under development and shovel-ready projects.1

SPOILER ALERT:

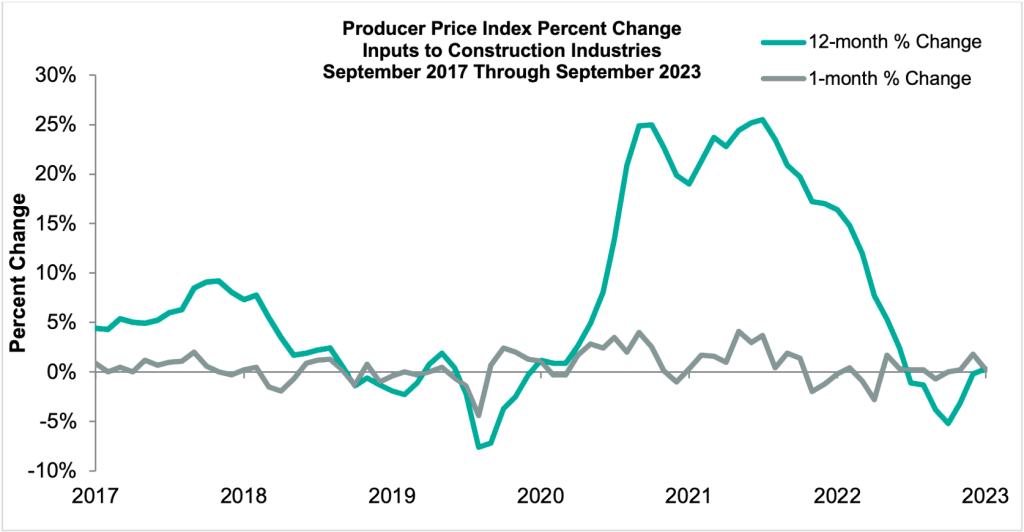

Early signs of price stability have begun to emerge, owing in part to an easing of supply chain constraints, giving builders and investors alike a reason to be optimistic about 2024.

Heading into 2024, inflation’s impact on certain construction materials is showing signs of easing and developers are now reporting greater market stability, suggesting that many of the supply-chain headwinds that formerly impeded competition may be easing. However, a tight lending environment is serving as a greater deterrent to development than the supply chain ever could, thereby keeping competition at bay.

(Click image to view larger)

Source: Associated Builders and Contractors

Ignite Investments had the opportunity to speak with Encore Enterprise’s Dwayne Rash, a prominent contractor with over 30 years of commercial and industrial construction experience and the President of Encore Construction. He shared what the Encore team is experiencing on the development side of the market and his forecast for 2024.

Q&A WITH DWAYNE RASH, ENCORE ENTERPRISES PRESIDENT OF CONSTRUCTION

Ignite: What is your outlook for 2024 in terms of construction material pricing, the supply chain, and the labor market?

Dwayne: I think the supply chain will continue to improve. I believe it will be less demand, not increased capacity, that will allow manufacturers to get product out more quickly. For long-term items like HVAC equipment, and electrical switch gears, I think those deliveries will shorten. Many projects are on hold because of interest rates and labor tightening, but in 2024, we expect the labor market not to be so tight. I’ve talked to a couple of general contractors we work with who can see what’s booked for 2024, and they have already seen some pricing in the labor market start to come back.

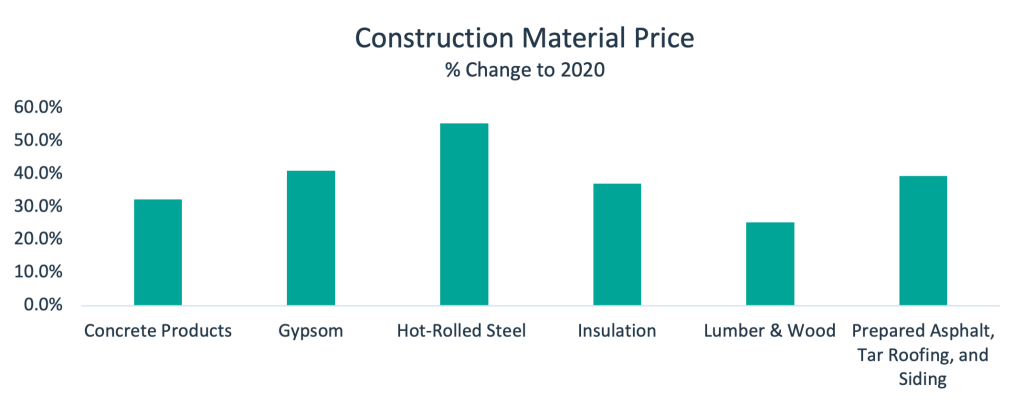

Ignite: How would you characterize the current environment for construction material prices?

Dwayne: Pricing has remained elevated in 2023 on our projects across all markets. I would rank lumber prices as the most volatile while prices for steel, elevators, drywall, HVAC, and electrical have all seen steady increases. For example, we priced an elevator for a project in February 2023 and again in August, and the price had increased almost 30%. For the elevators we purchased in 2022, the supplier required a 50% deposit upon placing the order. Fortunately, by doing that, we were able to hold onto those prices and avoid any increases.

IGNITE PERSPECTIVE

Construction pricing coupled with the increased cost of capital continues to pressure underwriting, thereby further emphasizing the importance of asset locations in markets with sustainable demand drivers and positive in-migration trends.

(Click image to view larger)

Ignite: What has been the trickiest hurdle to navigate across development projects the last few years?

Dwayne: Permitting and licensing. Municipalities all worked remotely during COVID, and it seems like some of them have not gotten back up to 100% since then. For one of our projects, the permit came three months after the city and county said it would be ready. Not only does this delay construction start but it requires our team to push contractors to hold original pricing in an already volatile commodities market. Occasionally, you get lucky, and the price will go down. But most of the time they continue to go up.

Ignite: Supply chain disruptions have been particularly pronounced since the pandemic, exacerbated by geopolitical tensions. What are you seeing on the supply/demand side? Are lead times showing any signs of returning to normal?

Dwayne: I would not say normal, but they have reduced in length. For bigger HVAC systems, deliveries can be up to 42 weeks. This sounds terrible, but the solution is to put a deposit down and purchase early, which also helps hold the price, and becomes a huge advantage for developers like Encore.

Ignite: How important are supplier and contractor relationships in this environment?

Dwayne: They’re critical. We try to use local contractors whenever possible because they have the relationships. If you’re from out of town, you’re at the bottom of the list no matter when you made the order, but if you’re using a local contractor, they’ll get preferential treatment. Relationships make a big difference, as they do in everything.

Ignite: Let’s shift gears and talk about the labor market shortage and wages. According to reports, the U.S. construction industry is facing a gap of 650,000 workers. Construction worker wages are hovering at nearly $35 per hour on average, reflecting a wage premium of almost 19% versus the average for private sector workers. Is Encore feeling the pinch and how is it affecting budgets on projects?

Dwayne: It’s simple economics. Five years ago, we had a project where a forklift operator left the machine running for a job down the road that offered him $5 more per hour. Whoever’s paying $1 more an hour, people are leaving for it.

Ignite: Sounds fiercely competitive. How is Encore navigating the labor market dynamics today?

Dwayne: It has impacted all the wood-framed projects. Our multi-family project in Ft. Myers has a different workforce since it was a concrete project and they have not been as impacted. The block and plank construction that we are doing in Ft. Myers requires a more skilled workforce. However, the number of actual employes required is less. The cost of a block and plank project is more expensive than wood-framed to build, but the insurance coverage and the longevity of the buildings pay for themselves quickly. In 2024, we expect the labor market to be less tight.

Ignite: The industry has been abuzz about modular construction as a solution to supply chain constraints. Does this approach fit into Encore’s model?

(Click image to view larger)

Dwayne: This has not been possible for us in the past because almost all our developments are custom built, but we are about to start modular construction for one of our divisions, Encore Restaurants. We will be building 7 Brew coffee stands, kind of like smaller Starbucks buildings, and they will be totally modular. Depending on the weather, the site will have about two months of utility, foundation, and paving work, but the stand itself is built in a warehouse and then gets trucked in. Once it arrives at the location, it’s done in two weeks. We aim to have 20 of these built by the end of next year.

Ignite: Despite challenging market conditions, Encore has not skipped a beat. Do you expect this pace to continue in 2024 or slow down?

Dwayne: We see a pretty good next year. We are full-steam ahead and not slowing down. Have you met Doc (Dr. Sangani, Chairman and CEO of Encore Enterprises)? He doesn’t let anybody slow down.

Ignite: Thank you for your time, Dwayne.

Dwayne: Anytime.

TAKEAWAY

There’s no denying that the construction industry has been up against some fierce headwinds of late that have made commercial real estate development more challenging. Nevertheless, developers like Encore that have been able to rise above the storm are looking forward to an improved construction market ahead, including greater construction material price stability, an easing of the supply chain, and a looser labor market in 2024.

The information contained herein is for informational and educational purposes only and is not an offer to sell or a solicitation of any offer to buy any securities. The information contained herein is not intended to and does not constitute investment, legal, or tax advice, or recommendation of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Any investment in securities involves a high degree of risk and may not be suitable for all investors and you should consult with an expert before making investment decisions. The views or opinions expressed herein represent those of Ignite Investments, LLC (“Ignite”) or its affiliated sponsors at the time of publication. No assurance can be provided that any of the future events referenced herein (including but not limited to projected or estimated returns or performance results) will occur on the terms contemplated herein or at all. While the data contained herein has been prepared from information that Ignite believes to be reliable, Ignite does not warrant the accuracy or completeness of such information. Please see Terms & Conditions for full disclosures.

Investments in commercial real estate (CRE) involve significant risks, including market risks, interest rate risks, and liquidity risks, and may not be suitable for all investors.

Securities transactions conducted through Umergence, LLC. Member: FINRA/SIPC. Umergence is not affiliated with any entities identified in this communication.

© 2023 IGNITE INVESTMENTS, LLC